- After-Hours Trading(Noun)

- /af-ter ow-ers tray-ding/

- Definition: The buying and selling of securities outside the standard trading hours of the stock exchange, typically occurring after the market closes.

- Etymology: "After" from Old English "æfter," meaning "following in time," "hours" from Old English "ūre," meaning "time," and "trading" from Old English "trād," meaning "path or track." After-hours trading refers to transactions that take place outside normal market hours.

- Similar: Extended trading

- Opposite: Regular trading hours

- Example: "Investors can participate in after-hours trading to react to earnings reports released after the market closes."

- Ask Price(Noun)

- /ask prahys/

- Definition: The lowest price a seller is willing to accept for a security in the market, often contrasted with the bid price.

- Etymology: "Ask" from Old English "ascian," meaning "to request," and "price" from Old French "pris," meaning "value." The ask price is the seller's minimum acceptable offer.

- Similar: Offer price

- Opposite: Bid price

- Example: "The ask price for the stock was $50, but buyers were only bidding $49."

- Bearish(Adjective)

- /bair-ish/

- Definition: A term used to describe a market or investor sentiment that anticipates a decline in stock prices, often leading to selling activity.

- Etymology: "Bear" from Old English "bera," associated with downward movement or strength, and "-ish" indicating a characteristic. In finance, bearish refers to expectations of falling prices.

- Similar: Pessimistic, Negative

- Opposite: Bullish

- Example: "The market was bearish after the disappointing earnings reports, leading to a sell-off."

- Bid Price(Noun)

- /bid prahys/

- Definition: The highest price a buyer is willing to pay for a security in the market, often contrasted with the ask price.

- Etymology: "Bid" from Old English "biddan," meaning "to ask," and "price" from Old French "pris," meaning "value." The bid price represents the buyer's maximum offer.

- Similar: Purchase price

- Opposite: Ask price

- Example: "The bid price for the shares was $48, slightly below the current market price."

- Blue Chip(Noun)

- /bloo chip/

- Definition: A nationally recognized, well-established, and financially sound company with a history of reliable performance, often included in major stock market indexes.

- Etymology: "Blue" from Old French "bleu," meaning "blue," and "chip" from Old English "cipp," meaning "a small piece." In poker, blue chips are traditionally the highest value, symbolizing the reliability and strength of blue-chip stocks.

- Similar: Large-cap stock

- Opposite: Penny stock

- Example: "Investors often seek blue-chip stocks for their stability and consistent dividends."

- Broker(Noun)

- /broh-ker/

- Definition: An individual or firm that acts as an intermediary between buyers and sellers in financial markets, facilitating the buying and selling of securities.

- Etymology: From Old French "broceur," meaning "small trader," with the modern term referring to intermediaries in the stock market.

- Similar: Agent, Middleman

- Example: "She contacted her broker to place an order for 100 shares of the company."

- Brokerage Account(Noun)

- /broh-ker-ij uh-kount/

- Definition: An investment account through which an investor can buy and sell securities such as stocks, bonds, and mutual funds, typically managed by a brokerage firm.

- Etymology: "Brokerage" from Old French "broceur," meaning "small trader," and "account" from Old French "acont," meaning "a reckoning." Brokerage accounts are used to hold and manage investments.

- Similar: Investment account

- Opposite: Savings account

- Example: "She opened a brokerage account to start investing in the stock market."

- Bullish(Adjective)

- /bool-ish/

- Definition: A term used to describe a market or investor sentiment that anticipates an increase in stock prices, often leading to buying activity.

- Etymology: "Bull" from Old English "bula," associated with upward movement or strength, and "-ish" indicating a characteristic. In finance, bullish refers to expectations of rising prices.

- Similar: Optimistic, Positive

- Opposite: Bearish

- Example: "Investors were bullish on the tech sector, driving stock prices higher."

- Buy(Verb)

- /bahy/

- Definition: The action of purchasing a security or asset in the financial markets, with the expectation that it will increase in value.

- Etymology: From Old English "bycgan," meaning "to purchase." In finance, buying is the act of acquiring an asset for investment purposes.

- Similar: Purchase, Acquire

- Opposite: Sell

- Example: "He decided to buy 50 shares of the company after reading the positive earnings report."

- Capital Loss(Noun)

- /kap-i-tl laws/

- Definition: The loss incurred when a capital asset, such as an investment or real estate, decreases in value and is sold for less than its purchase price.

- Etymology: "Capital" from Latin "caput," meaning "head or principal," and "loss" from Old English "los," meaning "destruction." A capital loss occurs when the sale price of an asset is lower than its purchase price.

- Similar: Investment loss

- Opposite: Capital gain

- Example: "He reported a capital loss on his tax return after selling the stock at a lower price than he paid."

- Circuit Breaker(Noun)

- /sur-kit brey-ker/

- Definition: A mechanism in financial markets designed to temporarily halt trading on an exchange in response to significant price declines, intended to prevent panic selling and excessive volatility.

- Etymology: "Circuit" from Latin "circuitus," meaning "a going around," and "breaker" from Old English "brecan," meaning "to break." In finance, a circuit breaker stops trading to curb market volatility.

- Similar: Trading halt

- Example: "The market hit the circuit breaker after a sharp decline in stock prices triggered the automatic trading halt."

- Common Stock(Noun)

- /kom-uhn stok/

- Definition: A type of security that represents ownership in a corporation, giving shareholders voting rights and a claim on part of the company’s profits through dividends.

- Etymology: "Common" from Latin "communis," meaning "shared by all," and "stock" from Old English "stocc," meaning "a tree trunk," symbolizing a portion of ownership in a company.

- Similar: Equity, Shares

- Opposite: Preferred stock

- Example: "Common stockholders have voting rights in the company and may receive dividends if declared."

- Demand(Noun)

- /dih-mand/

- Definition: The desire and ability of consumers or investors to purchase goods, services, or assets at various prices during a specific period.

- Etymology: From Old French "demander," meaning "to ask or request." In economics, demand refers to the willingness and ability to purchase goods or assets.

- Similar: Desire, Market interest

- Opposite: Supply

- Example: "High demand for tech stocks drove their prices up sharply during the trading session."

- Dow Jones(Noun)

- /dou jonz/

- Definition: A stock market index that measures the stock performance of 30 large, publicly-owned companies listed on stock exchanges in the United States, often used as a benchmark for the overall market.

- Etymology: Named after Charles Dow and Edward Jones, founders of Dow Jones & Company. The Dow Jones index tracks the performance of leading companies in various industries.

- Similar: DJIA, The Dow

- Example: "The Dow Jones closed up 200 points, reflecting gains in industrial and financial stocks."

- DRIP (Dividend Reinvestment Plan)(Noun)

- /drip/

- Definition: A plan that allows investors to automatically reinvest their cash dividends into additional shares or partial shares of the underlying stock, often without paying commissions.

- Etymology: "Dividend" from Latin "dividendum," meaning "thing to be divided," "reinvestment" from Old French "reinvestir," meaning "to clothe again," and "plan" from Latin "planus," meaning "flat or level." DRIP allows investors to compound their investment by reinvesting dividends.

- Similar: Reinvestment plan

- Opposite: Cash dividend

- Example: "He enrolled in a DRIP to increase his holdings without having to pay additional fees."

- Earnings(Noun)

- /ur-ningz/

- Definition: The profit that a company generates from its operations, typically reported on a quarterly or annual basis, and often used as a key indicator of a company's financial health.

- Etymology: From Old English "earnian," meaning "to earn." Earnings represent the net income a company earns after deducting all expenses.

- Similar: Profit, Income

- Opposite: Loss

- Example: "The company's earnings exceeded analysts' expectations, driving its stock price higher."

- Earnings Per Share (EPS)(Noun)

- /ur-ningz pur shair/

- Definition: A financial metric that represents the portion of a company's profit allocated to each outstanding share of common stock, calculated as net income divided by the number of outstanding shares.

- Etymology: "Earnings" from Old English "earnian," meaning "to earn," "per" from Latin "per," meaning "by or through," and "share" from Old English "scearu," meaning "a portion." EPS is a key indicator of a company’s profitability.

- Similar: Profit per share

- Example: "The company reported earnings per share of $2.50, up from $2.10 the previous year."

- Electronic Trading(Noun)

- /ih-lek-tron-ik tray-ding/

- Definition: The process of buying and selling securities using computer systems and networks, allowing for faster and more efficient transactions compared to traditional open outcry trading.

- Etymology: "Electronic" from Greek "elektron," meaning "amber," and "trading" from Old English "trād," meaning "path or track." Electronic trading replaces physical trading floors with digital platforms.

- Similar: E-trading, Online trading

- Opposite: Floor trading

- Example: "Electronic trading platforms have made it easier for individual investors to trade stocks from anywhere in the world."

- Equity(Noun)

- /ek-wi-tee/

- Definition: The value of an ownership interest in a company, represented by the difference between the value of the assets and liabilities, often referred to as shareholders' equity.

- Etymology: From Old French "equité," meaning "fairness or justice." In finance, equity represents the ownership value in a company.

- Similar: Ownership, Stock

- Opposite: Debt

- Example: "Investors buy equity in a company to gain a share of its profits and voting rights."

- ETF (Exchange-Traded Fund)(Noun)

- /ee-tee-ef/

- Definition: A type of investment fund that is traded on stock exchanges, much like stocks, and typically holds assets such as stocks, bonds, or commodities.

- Etymology: "Exchange" from Old French "eschange," meaning "a change," "traded" from Old English "trād," meaning "path or track," and "fund" from Old French "fons," meaning "bottom or base." ETFs offer a way to invest in a diversified portfolio of assets.

- Similar: Index fund (in some contexts)

- Opposite: Mutual fund (in some contexts)

- Example: "She invested in an ETF that tracks the S&P 500, giving her exposure to a broad range of stocks."

- Exchange(Noun)

- /iks-chaynj/

- Definition: A marketplace where securities, commodities, derivatives, and other financial instruments are traded, often referred to as a stock exchange when dealing with equities.

- Etymology: From Old French "eschange," meaning "a change." An exchange facilitates the buying and selling of financial assets.

- Similar: Market, Bourse

- Opposite: Over-the-counter (OTC)

- Example: "The New York Stock Exchange is one of the largest and most well-known exchanges in the world."

- Financial Markets(Noun)

- /fahy-nan-shuhl mahr-kits/

- Definition: Markets where securities, commodities, derivatives, and other financial instruments are bought and sold, including stock markets, bond markets, and forex markets.

- Etymology: "Financial" from Latin "financia," meaning "ending or payment," and "markets" from Latin "mercatus," meaning "trade." Financial markets are platforms where buyers and sellers engage in financial transactions.

- Similar: Capital markets, Investment markets

- Example: "Financial markets play a crucial role in the economy by facilitating the allocation of resources and capital."

- Float(Noun)

- /floht/

- Definition: The total number of shares of a company's stock that are available for trading by the public, excluding closely held shares and restricted stock.

- Etymology: From Old English "flotian," meaning "to float or swim." In finance, float refers to the shares available for trading in the market.

- Similar: Public float, Share float

- Opposite: Locked-up shares

- Example: "The company's float increased after the lock-up period expired, allowing more shares to be traded."

- Fractional Shares(Noun)

- /frak-shuh-nl shairz/

- Definition: Portions of a share of stock that are less than one full share, allowing investors to buy smaller portions of a company's stock, often through dividend reinvestment or certain brokerage services.

- Etymology: "Fractional" from Latin "fractionem," meaning "a breaking," and "shares" from Old English "scearu," meaning "a portion." Fractional shares allow investors to own a piece of a share rather than a full share.

- Similar: Partial shares

- Opposite: Whole shares

- Example: "Fractional shares enable small investors to buy into expensive stocks without needing to purchase a full share."

- Growth Stock(Noun)

- /grohth stok/

- Definition: A stock from a company that is expected to grow at an above-average rate compared to other companies, often characterized by high earnings growth potential and minimal dividend payments.

- Etymology: "Growth" from Old English "growan," meaning "to grow," and "stock" from Old English "stocc," meaning "a tree trunk." Growth stocks are anticipated to increase in value more rapidly than average stocks.

- Similar: High-growth stock

- Opposite: Value stock

- Example: "Investors often seek growth stocks in sectors like technology, where companies can rapidly increase their earnings."

- Income Stock(Noun)

- /in-kuhm stok/

- Definition: A type of stock that typically pays regular, high dividends to shareholders and has a stable earnings record, appealing to investors seeking income rather than capital appreciation.

- Etymology: "Income" from Old English "incuman," meaning "to come in," and "stock" from Old English "stocc," meaning "a tree trunk." Income stocks provide a steady income stream through dividends.

- Similar: Dividend stock

- Opposite: Growth stock

- Example: "Retirees often prefer income stocks for the steady dividend payments they provide."

- Index(Noun)

- /in-deks/

- Definition: A statistical measure that tracks the performance of a group of assets, such as stocks, bonds, or commodities, often used as a benchmark to gauge the overall performance of a market or sector.

- Etymology: From Latin "index," meaning "forefinger or pointer." In finance, an index points to the performance of a specific group of securities.

- Similar: Benchmark, Indicator

- Example: "The S&P 500 is a widely followed index that tracks the performance of 500 large U.S. companies."

- Industry(Noun)

- /in-duh-stree/

- Definition: A group of companies that produce similar products or services, forming a distinct sector of the economy, often categorized by specific types of production or service.

- Etymology: From Latin "industria," meaning "diligence or activity." In economics, an industry represents a particular segment of the economy.

- Similar: Sector, Field

- Example: "The automotive industry has been rapidly adopting new technologies to stay competitive."

- Investor(Noun)

- /in-ves-ter/

- Definition: An individual or entity that allocates capital with the expectation of receiving financial returns, typically through buying stocks, bonds, real estate, or other investment vehicles.

- Etymology: From Latin "investire," meaning "to clothe or adorn." An investor "invests" money into an asset with the expectation of future gains.

- Similar: Shareholder, Stakeholder

- Opposite: Speculator (in certain contexts)

- Example: "The investor diversified her portfolio to reduce risk and increase potential returns."

- IPO (Initial Public Offering)(Noun)

- /ih-nish-uhl puh-blik aw-fer-ing/

- Definition: The process by which a private company offers shares to the public for the first time, typically to raise capital by selling part of its ownership on a stock exchange.

- Etymology: "Initial" from Latin "initialis," meaning "beginning," "public" from Latin "publicus," meaning "of the people," and "offering" from Old English "offrung," meaning "a presentation." An IPO marks the transition of a private company to a publicly traded one.

- Similar: Public offering, Stock market debut

- Opposite: Private placement

- Example: "The tech company's IPO was highly anticipated, with shares surging on the first day of trading."

- Large Cap(Noun)

- /lahrj kap/

- Definition: Refers to companies with a large market capitalization, typically over $10 billion, considered to be established and stable, often offering lower risk compared to smaller companies.

- Etymology: "Large" from Latin "largus," meaning "abundant," and "cap" from "capitalization," derived from Latin "caput," meaning "head." Large-cap companies are significant players in their industries.

- Similar: Big-cap stock

- Opposite: Small-cap

- Example: "Large-cap stocks are often favored by conservative investors due to their stability and reliable dividends."

- Leverage(Noun)

- /lev-er-ij/

- Definition: The use of borrowed capital or financial instruments to increase the potential return on investment, amplifying both gains and losses.

- Etymology: From Old French "levier," meaning "to raise." In finance, leverage refers to using debt to increase investment exposure.

- Similar: Gearing, Debt financing

- Opposite: Deleveraging

- Example: "The company used leverage to finance its expansion, increasing its debt but also its potential returns."

- Liquidity(Noun)

- /li-kwid-i-tee/

- Definition: The ease with which an asset can be quickly converted into cash without significantly affecting its market price, essential for market efficiency and stability.

- Etymology: From Latin "liquidus," meaning "fluid." Liquidity in finance refers to how readily assets can be turned into cash.

- Similar: Cashability, Marketability

- Opposite: Illiquidity

- Example: "High liquidity in the stock market ensures that shares can be bought or sold quickly at stable prices."

- Margin(Noun)

- /mahr-jin/

- Definition: The difference between the total value of securities held in an investor's account and the loan amount from a broker, also refers to the collateral deposited to cover the credit risk of a financial transaction.

- Etymology: From Old French "marge," meaning "edge or border." In finance, margin refers to the leverage used in trading and the required collateral.

- Similar: Collateral, Cushion

- Opposite: Full payment

- Example: "Trading on margin allows investors to buy more shares than they could with just their cash."

- Market(Noun)

- /mahr-kit/

- Definition: A venue where buyers and sellers meet to exchange goods, services, or financial instruments, often referring to stock markets or other financial exchanges.

- Etymology: From Latin "mercatus," meaning "trade or commerce." In finance, the market is where financial assets are traded.

- Similar: Exchange, Marketplace

- Example: "The stock market reacted sharply to the news, with significant price swings in many sectors."

- Market Cap(Noun)

- /mahr-kit kap/

- Definition: Short for market capitalization, it refers to the total market value of a company's outstanding shares, calculated by multiplying the current stock price by the total number of outstanding shares.

- Etymology: "Market" from Latin "mercatus," meaning "trade," and "cap" from "capitalization," derived from Latin "caput," meaning "head." Market cap reflects the size and value of a company.

- Similar: Market value

- Example: "Apple's market cap exceeded $2 trillion, making it one of the most valuable companies in the world."

- Market Hours(Noun)

- /mahr-kit ow-ers/

- Definition: The official operating hours during which an exchange or financial market is open for trading, typically from 9:30 AM to 4:00 PM Eastern Time in the U.S.

- Etymology: "Market" from Latin "mercatus," meaning "trade," and "hours" from Old English "ūre," meaning "time." Market hours define the period when trading is active.

- Similar: Trading hours

- Opposite: After-hours trading

- Example: "Most trading activity occurs during regular market hours, but after-hours trading is also possible."

- Mid Cap(Noun)

- /mid kap/

- Definition: Refers to companies with a medium market capitalization, typically between $2 billion and $10 billion, considered to offer a balance between growth potential and stability.

- Etymology: "Mid" from Old English "mid," meaning "middle," and "cap" from "capitalization," derived from Latin "caput," meaning "head." Mid-cap companies are often in a growth phase.

- Similar: Medium-cap stock

- Opposite: Small-cap, Large-cap

- Example: "Mid-cap stocks are often sought by investors looking for growth with less risk than small caps."

- Mutual Fund(Noun)

- /myoo-choo-uhl fund/

- Definition: An investment vehicle that pools money from multiple investors to purchase a diversified portfolio of securities, managed by a professional investment manager.

- Etymology: "Mutual" from Latin "mutuus," meaning "borrowed or exchanged," and "fund" from Old French "fons," meaning "bottom or base." Mutual funds allow investors to diversify their portfolios.

- Similar: Investment fund

- Opposite: Individual stock (in some contexts)

- Example: "Mutual funds provide small investors with access to diversified portfolios managed by professionals."

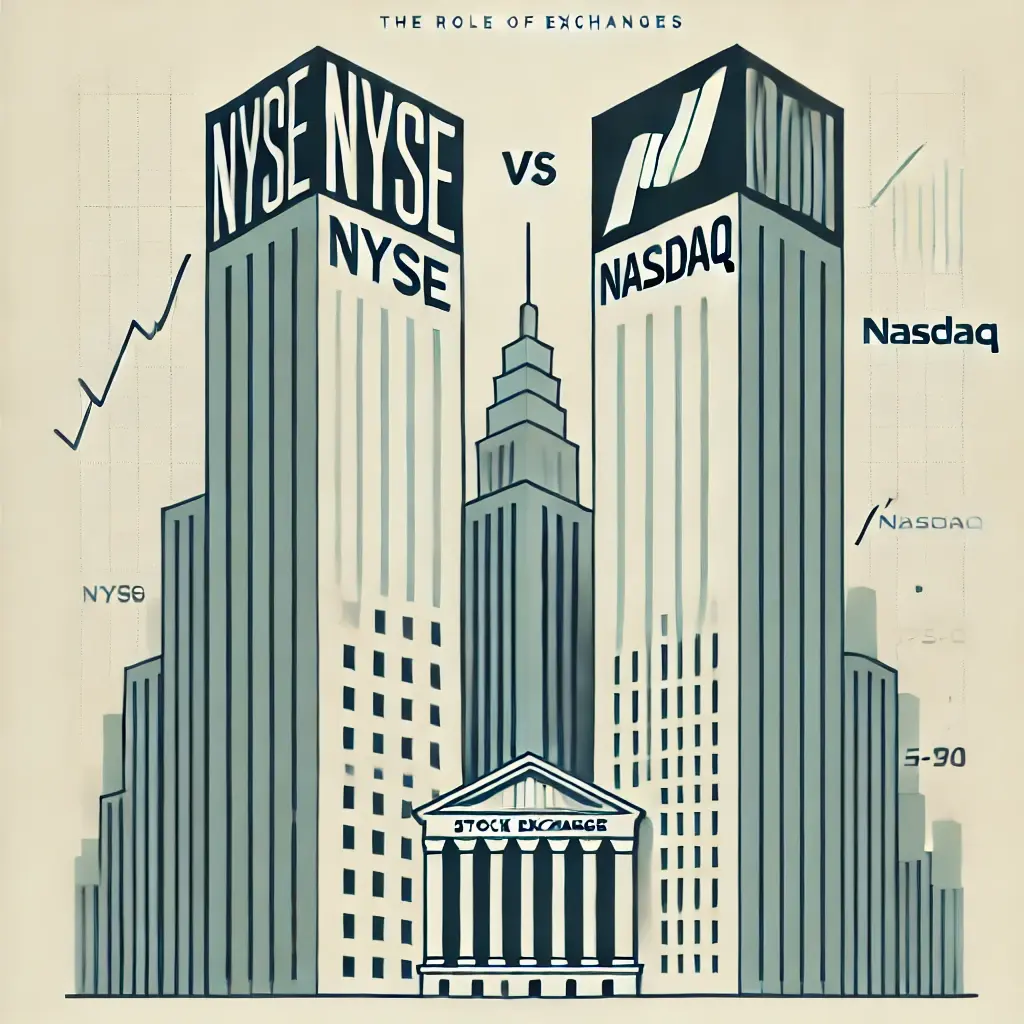

- NASDAQ(Noun)

- /naz-dak/

- Definition: An American stock exchange known for its electronic trading platform and its focus on technology companies, officially known as the National Association of Securities Dealers Automated Quotations.

- Etymology: An acronym derived from the full name "National Association of Securities Dealers Automated Quotations." NASDAQ is associated with tech-heavy listings.

- Opposite: NYSE (in some contexts)

- Example: "The NASDAQ Composite Index is widely followed as a barometer of the technology sector's performance."

- NYSE (New York Stock Exchange)(Noun)

- /en-wy-ess-ee/

- Definition: The largest stock exchange in the world by market capitalization of listed companies, located in New York City and known for its floor-based trading system.

- Etymology: "New York" from the English colonial name for the city, "Stock" from Old English "stocc," and "Exchange" from Latin "exchangium," meaning "to trade." The NYSE is a symbol of global finance.

- Similar: The Big Board

- Opposite: NASDAQ (in some contexts)

- Example: "The NYSE is home to many of the world’s largest and most prestigious companies."

- Odd Lot(Noun)

- /od lot/

- Definition: A stock transaction that involves fewer shares than the standard trading unit, typically less than 100 shares, often resulting in higher trading fees.

- Etymology: "Odd" from Old Norse "oddi," meaning "point or triangle," and "lot" from Old English "hlot," meaning "portion or share." An odd lot is a non-standard amount of shares traded.

- Similar: Small lot

- Opposite: Round lot

- Example: "Buying an odd lot of 50 shares may result in higher per-share trading costs than purchasing a round lot."

- Order Book(Noun)

- /awr-der book/

- Definition: A digital or physical record of all buy and sell orders for a particular security, organized by price level, used by traders to gauge market depth and liquidity.

- Etymology: "Order" from Latin "ordinare," meaning "to arrange," and "book" from Old English "bōc," meaning "a written document." The order book shows all pending buy and sell orders for a security.

- Similar: Order ledger

- Example: "The order book showed strong demand for the stock at lower price levels, suggesting support."

- Penny Stock(Noun)

- /pen-ee stok/

- Definition: A stock that trades at a low price, typically under $5 per share, and often belongs to small, less-established companies, considered highly speculative and risky.

- Etymology: "Penny" from Old English "pening," meaning "small coin," and "stock" from Old English "stocc," meaning "a tree trunk." Penny stocks are low-priced shares with high volatility.

- Similar: Micro-cap stock

- Opposite: Blue-chip stock

- Example: "Penny stocks can offer high returns but are also associated with significant risk and volatility."

- Portfolio(Noun)

- /pawrt-foh-lee-oh/

- Definition: A collection of investments held by an individual or institution, typically diversified across different asset classes such as stocks, bonds, and real estate to manage risk.

- Etymology: From Italian "portafoglio," meaning "a case for carrying documents." In finance, a portfolio refers to the aggregate holdings of an investor.

- Similar: Investment portfolio

- Opposite: Single investment

- Example: "Her portfolio is diversified across various sectors, including technology, healthcare, and energy."

- Pre-Market Trading(Noun)

- /pree-mahr-kit tray-ding/

- Definition: The buying and selling of securities on an exchange before the official market opening hours, allowing investors to react to news and events occurring outside regular trading hours.

- Etymology: "Pre-" from Latin "prae," meaning "before," and "market" from Latin "mercatus," meaning "trade." Pre-market trading occurs before the standard trading session begins.

- Similar: Early trading

- Opposite: After-hours trading

- Example: "Pre-market trading showed a surge in stock prices following the company’s earnings announcement."

- Private Company(Noun)

- /pry-vit kuhmp-uh-nee/

- Definition: A company that is owned by private individuals or entities and does not have its shares publicly traded on a stock exchange, often subject to fewer regulatory requirements.

- Etymology: "Private" from Latin "privatus," meaning "restricted to one’s self," and "company" from Latin "companionem," meaning "companion." A private company’s shares are not available to the public.

- Similar: Privately held company

- Opposite: Public company

- Example: "The private company decided to go public through an IPO to raise capital for expansion."

- Public Company(Noun)

- /puh-blik kuhmp-uh-nee/

- Definition: A company whose shares are traded openly on stock exchanges, with ownership distributed among public shareholders, and subject to strict regulatory and reporting requirements.

- Etymology: "Public" from Latin "publicus," meaning "of the people," and "company" from Latin "companionem," meaning "companion." Public companies have their shares available for purchase by the general public.

- Similar: Publicly traded company

- Opposite: Private company

- Example: "As a public company, it must file quarterly earnings reports and comply with SEC regulations."

- Regulator(Noun)

- /reg-yuh-ley-ter/

- Definition: A government or independent authority responsible for supervising and enforcing laws and regulations within financial markets to ensure fairness, transparency, and investor protection.

- Etymology: From Latin "regulare," meaning "to control or guide." Regulators oversee financial markets to maintain stability and fairness.

- Similar: Oversight authority, Supervisor

- Opposite: Deregulator (in some contexts)

- Example: "The regulator imposed fines on the firm for violating trading rules and failing to disclose material information."

- Reverse Split(Noun)

- /ree-vurs split/

- Definition: A corporate action in which a company reduces the number of its outstanding shares while increasing the share price proportionally, often to meet exchange listing requirements or enhance the stock’s appeal.

- Etymology: "Reverse" from Latin "revertere," meaning "to turn back," and "split" from Old English "splittan," meaning "to divide." A reverse split consolidates shares, resulting in fewer shares at a higher price.

- Similar: Share consolidation

- Opposite: Stock split

- Example: "The company announced a 1-for-10 reverse split to increase its share price and remain listed on the NASDAQ."

- Reward(Noun)

- /ri-wawrd/

- Definition: The potential gain or profit from an investment, typically considered in relation to the risk involved, with higher rewards generally associated with higher risks.

- Etymology: From Old French "rewarder," meaning "to give in return." In finance, reward refers to the financial benefits gained from an investment.

- Similar: Return, Profit

- Opposite: Risk

- Example: "Investors weigh the potential reward against the risk before making investment decisions."

- Risk(Noun)

- /risk/

- Definition: The possibility of losing some or all of an investment or facing uncertainty in the expected return, often associated with volatility and market fluctuations.

- Etymology: From Old Italian "risco," meaning "danger." In finance, risk refers to the chance of financial loss.

- Similar: Uncertainty, Hazard

- Opposite: Security

- Example: "Diversifying a portfolio can help mitigate risk by spreading investments across different assets."

- Round Lot(Noun)

- /: round lot/

- Definition: A standard trading unit in the stock market, typically consisting of 100 shares or multiples of 100, used as a benchmark for quoting and executing trades.

- Etymology: "Round" from Old English "rund," meaning "circular," and "lot" from Old English "hlot," meaning "portion or share." A round lot is the standard unit for trading shares.

- Similar: Standard lot

- Opposite: Odd lot

- Example: "Institutional investors usually trade in round lots to ensure efficient order execution."

- S&P 500(Noun)

- /ess and pee fahyv-hun-drid/

- Definition: A stock market index that tracks the stock performance of 500 large companies listed on stock exchanges in the United States, widely regarded as a leading indicator of U.S. equities and economic health.

- Etymology: An abbreviation for "Standard & Poor’s," the financial services company that created the index. The S&P 500 is a benchmark for the overall U.S. stock market.

- Similar: SPX, The 500

- Example: "The S&P 500 has returned an average of about 10% annually over the past century, making it a popular choice for long-term investors."

- Sector(Noun)

- /sek-ter/

- Definition: A distinct part of the economy or market that groups companies providing similar products or services, such as technology, healthcare, or finance.

- Etymology: From Latin "sectio," meaning "a cutting or division." In finance, a sector represents a specific segment of the economy.

- Similar: Industry, Category

- Example: "The technology sector has outperformed other sectors in recent years due to rapid innovation and growth."

- Sell(Verb)

- /sel/

- Definition: The action of exchanging a security or asset for cash, often driven by profit-taking, rebalancing a portfolio, or reducing exposure to market risks.

- Etymology: From Old English "sellan," meaning "to give." In finance, selling is the act of liquidating a position in a security.

- Similar: Liquidate, Divest

- Opposite: Buy

- Example: "He decided to sell his shares after the stock reached his target price, securing a profit."

- Share(Noun)

- /shair/

- Definition: A unit of ownership in a corporation or financial asset, representing a claim on a portion of the company’s assets and earnings, and typically entitling the shareholder to vote on corporate matters.

- Etymology: From Old English "scearu," meaning "a portion." A share represents a fractional ownership in a company.

- Similar: Stock, Equity

- Opposite: Bond (in some contexts)

- Example: "Each share of the company provides the holder with voting rights and the potential to receive dividends."

- Shareholder(Noun)

- /shair-hohl-der/

- Definition: An individual or entity that owns shares in a corporation, holding a claim on part of the company's assets and earnings, and typically having the right to vote on corporate matters.

- Etymology: "Share" from Old English "scearu," meaning "a portion," and "holder" from Old English "healdan," meaning "to hold." A shareholder is an owner of shares in a company.

- Similar: Stockholder, Equity holder

- Opposite: Bondholder (in some contexts)

- Example: "As a shareholder, she received a portion of the company’s profits in the form of dividends."

- Small Cap(Noun)

- /smawl kap/

- Definition: Refers to companies with a small market capitalization, typically between $300 million and $2 billion, often associated with higher growth potential and higher risk compared to larger companies.

- Etymology: "Small" from Old English "smæl," meaning "narrow or thin," and "cap" from "capitalization," derived from Latin "caput," meaning "head." Small-cap stocks are often growth-oriented but can be volatile.

- Similar: Small-cap stock

- Opposite: Large-cap

- Example: "Investors looking for higher returns often invest in small-cap stocks, despite their higher risk."

- Spread(Noun)

- /spred/

- Definition: The difference between the bid price and the ask price of a security or asset, representing the cost of trading and the market maker’s profit.

- Etymology: From Old English "spriǣdan," meaning "to stretch out." In finance, spread refers to the gap between buy and sell prices.

- Similar: Bid-ask spread, Margin

- Example: "A narrow spread between the bid and ask prices indicates high liquidity and active trading in the stock."

- Stock(Noun)

- /stok/

- Definition: A type of security that represents ownership in a corporation, entitling the shareholder to a portion of the company’s assets and profits, often traded on stock exchanges.

- Etymology: From Old English "stocc," meaning "a tree trunk or stem." Stock represents a share of ownership in a corporation.

- Similar: Equity, Share

- Opposite: Bond (in some contexts)

- Example: "He bought stock in the company, hoping it would increase in value over time."

- Stock Exchange(Noun)

- /stok iks-chaynj/

- Definition: A regulated marketplace where securities such as stocks, bonds, and other financial instruments are bought and sold, providing a platform for companies to raise capital and for investors to trade shares.

- Etymology: "Stock" from Old English "stocc," and "exchange" from Old French "eschange," meaning "a change." A stock exchange is a venue for trading financial assets.

- Similar: Bourse, Market

- Opposite: Over-the-counter (OTC)

- Example: "The New York Stock Exchange is one of the oldest and most prominent stock exchanges in the world."

- Stock Price(Noun)

- /stok prahys/

- Definition: The current price at which a share of stock can be bought or sold on the open market, determined by supply and demand factors and often fluctuating throughout the trading day.

- Etymology: "Stock" from Old English "stocc," and "price" from Old French "pris," meaning "value." Stock price reflects the market value of a share in a company.

- Similar: Share price, Market price

- Example: "The stock price surged after the company announced better-than-expected quarterly earnings."

- Stop Loss(Noun)

- /stop laws/

- Definition: An order placed with a broker to buy or sell a security once it reaches a certain price, designed to limit an investor's loss on a position by automatically executing the trade when the price moves unfavorably.

- Etymology: "Stop" from Old English "stoppian," meaning "to plug or close," and "loss" from Old English "los," meaning "destruction." A stop loss order helps protect against significant losses.

- Similar: Stop order

- Opposite: Take profit order

- Example: "He set a stop loss at 10% below his purchase price to protect against a steep decline in the stock's value."

- Supply(Noun)

- /suh-plahy/

- Definition: The total amount of a particular good or service that is available to consumers or investors at various prices during a specific period, often contrasted with demand.

- Etymology: From Old French "soupleer," meaning "to fill up." In finance, supply refers to the availability of an asset in the market.

- Similar: Availability, Stock

- Opposite: Demand

- Example: "An increase in supply without a corresponding rise in demand typically leads to lower prices."

- Take Profit(Noun)

- /teyk prof-it/

- Definition: An order placed with a broker to sell a security once it reaches a certain price, designed to lock in a profit by automatically executing the trade when the price moves favorably.

- Etymology: "Take" from Old English "tacan," meaning "to grasp," and "profit" from Latin "proficere," meaning "to advance." A take profit order secures gains by selling an asset at a predetermined price.

- Similar: Profit target

- Opposite: Stop loss order

- Example: "He set a take profit order 20% above his purchase price to ensure he captures gains if the stock rises."

- Ticker Symbol(Noun)

- /tik-er sim-buhl/

- Definition: A unique series of letters assigned to a security for trading purposes, used to identify publicly traded companies on stock exchanges and facilitate electronic trading.

- Etymology: "Ticker" from the sound of early telegraphic printers, and "symbol" from Greek "symbolon," meaning "a sign." Ticker symbols are shorthand codes for stocks and other securities.

- Similar: Stock symbol

- Example: "The ticker symbol for Apple Inc. is AAPL, which investors use to place trades on the stock exchange."

- Trade(Verb)

- /trayd/

- Definition: The action of buying or selling securities, commodities, or other financial instruments in financial markets, often done through brokers or electronic trading platforms.

- Etymology: From Old English "trād," meaning "path or track." In finance, trading refers to the exchange of financial assets.

- Similar: Buy and sell, Exchange

- Opposite: Hold (in some contexts)

- Example: "He trades stocks daily, taking advantage of short-term market movements."

- Trading Floor(Noun)

- /tray-ding flawr/

- Definition: The physical space in a stock exchange or brokerage where traders buy and sell securities, often characterized by active, in-person bidding and trading before the advent of electronic trading.

- Etymology: "Trading" from Old English "trād," and "floor" from Old English "flor," meaning "ground or bottom." The trading floor was historically the hub of stock market activity.

- Similar: Trading pit

- Opposite: Electronic trading

- Example: "The trading floor of the New York Stock Exchange is famous for its bustling activity and iconic bell."

- Trading Halt(Noun)

- /tray-ding hawlt/

- Definition: A temporary suspension of trading on a particular security or the entire market, usually triggered by significant news, volatility, or regulatory concerns to prevent panic selling and maintain orderly markets.

- Etymology: "Trading" from Old English "trād," and "halt" from Old English "healtian," meaning "to limp or stop." A trading halt pauses market activity to prevent disorderly trading.

- Similar: Trading suspension

- Opposite: Trading resumption

- Example: "The stock experienced a trading halt after the company announced a major acquisition that caused extreme volatility."

- Value Stock(Noun)

- /val-yoo stok/

- Definition: A stock that is considered undervalued compared to its fundamental metrics such as earnings, dividends, and sales, often trading at a lower price relative to its intrinsic value, and appealing to value investors.

- Etymology: "Value" from Latin "valere," meaning "to be worth," and "stock" from Old English "stocc." Value stocks are seen as bargains by investors looking for stable, undervalued companies.

- Similar: Undervalued stock

- Opposite: Growth stock

- Example: "Warren Buffett is known for investing in value stocks that offer strong fundamentals at a discounted price."

- Voting Rights(Noun)

- /voh-ting rahyts/

- Definition: The rights granted to shareholders of a company, allowing them to vote on important corporate matters such as electing the board of directors, mergers, and other significant decisions, often proportional to the number of shares owned.

- Etymology: "Voting" from Old English "votan," meaning "to wish or desire," and "rights" from Old English "riht," meaning "justice or law." Voting rights give shareholders a say in corporate governance.

- Similar: Shareholder rights

- Opposite: Non-voting shares

- Example: "Common stockholders typically have voting rights, allowing them to influence the direction of the company."