I. Introduction

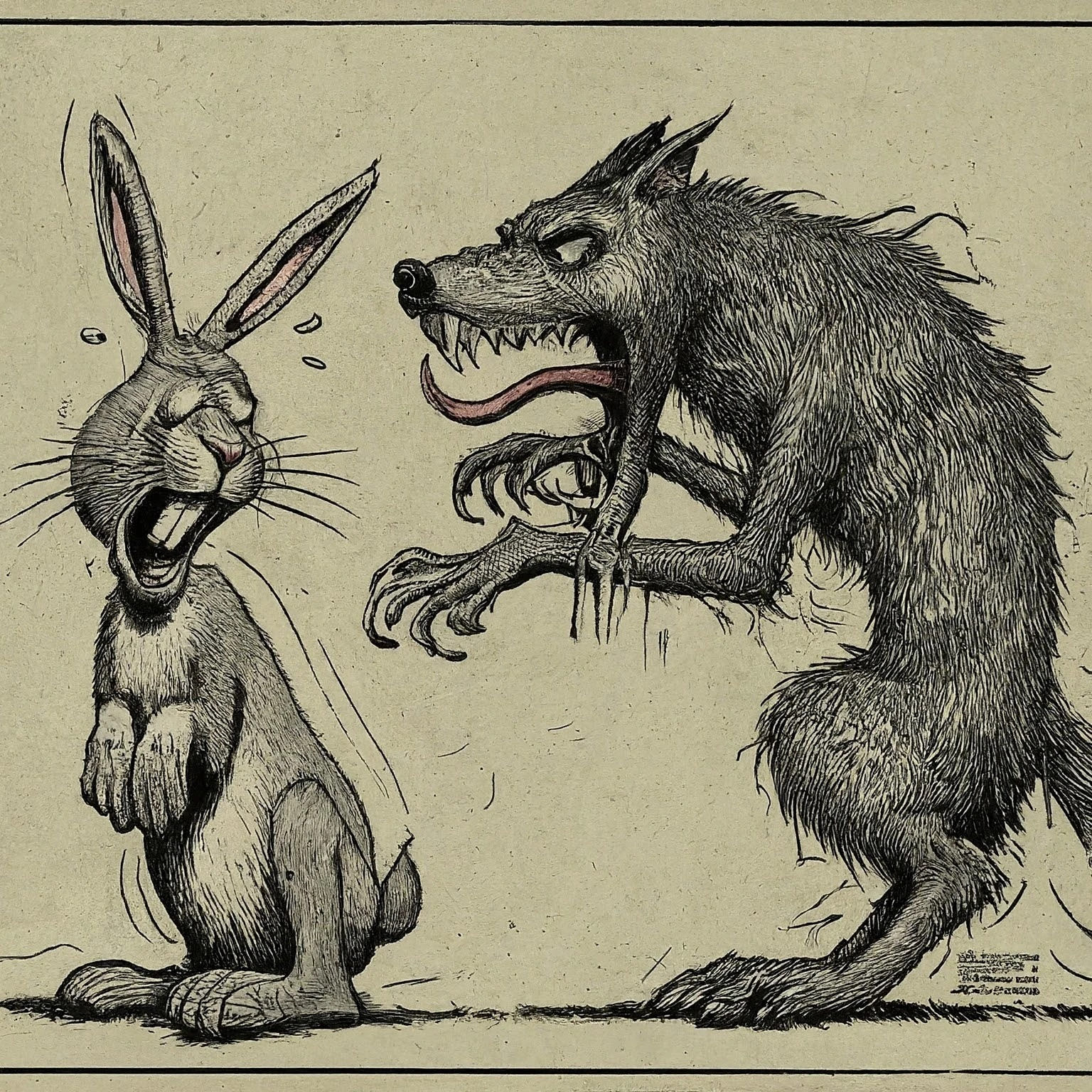

At its core, market sentiment encompasses the emotional climate that shapes financial markets. Understanding this dynamic can provide vital insights into asset performance. Central to this emotional landscape are two potent forces: fear and greed. When market conditions deteriorate, fear emerges, often compelling investors to sell off assets in a bid to mitigate losses. Consider a hypothetical trader, diligently monitoring his portfolio as a market plunge ensues. As fear grips the trading floor, he receives conflicting messages from various news sources. This scenario illustrates the overwhelming emotional responses triggered in high-stakes environments. This fear can lead investors to make impulsive decisions, such as panic selling, even when the fundamental value of investments does not warrant such actions. Schiller (2000) notes that the concern over escalating losses can push investors toward hasty choices, triggering panic selling even when the fundamental aspects of investments do not justify such reactions. Such behavior can result in significant financial losses that might have been avoided with a more level-headed approach.

Conversely, in times of market exuberance, greed can take hold, luring investors into high-risk purchases driven by the allure of substantial returns—sometimes overshadowing the necessity for a comprehensive assessment of associated risks. As pointed out by Baker and Wurgler (2007), investor sentiment plays a major role in explaining stock market returns, influencing market outcomes beyond rational justification by fundamentals. This highlights how market sentiment, fueled by emotions of fear and greed, can distort rational financial analysis and prompt decisions rooted in emotional rather than fiscal considerations.

For those experiencing the often tumultuous financial landscape, mastering market sentiment is crucial. Maneuvering through the market is akin to sailing through tempestuous waters; one must understand the winds of emotion to steer toward safe harbors. Emotional reactions tied to fear and greed can obfuscate judgment and breed impulsive decisions that jeopardize portfolios. By examining these psychological elements, investors can refine strategies, confidently adapting to market fluctuations and aligning financial decisions with long-term objectives.

This paper seeks to dissect the intricate interplay between fear and greed and their effects on investment decisions. Our aim is to illuminate the implications of these emotional currents on market behavior while providing actionable insights that empower readers to assess and respond effectively to the ever-evolving landscape of market sentiment.

II. Literature Review

A look into the historical significance of market sentiment unearths its profound influence on market dynamics and key incidents such as: - The Dot-Com Bubble: The Dot-Com Bubble serves as a testament to the siren songs of unchecked optimism that can ensnare even the most prudent investors. This was an illustration of unchecked greed, culminating in inflated valuations that ultimately led to a significant market correction, showing how positive sentiment can warp judgment. - The 2008 Financial Crisis: A period amplified by fear, triggering panic-driven sell-offs and resulting in a global economic crisis. During this time, psychological factors, including cognitive biases and loss aversion, profoundly impacted investor behavior. Tversky and Kahneman (1974) state that individuals are greatly affected by cognitive biases, such as loss aversion, often leading to irrational choices in uncertain situations. Here, loss aversion—the tendency to prioritize avoiding losses over acquiring gains—can lead to reactive and detrimental investment choices. - COVID-19 Market Reactions: As the pandemic unfolded, an initial wave of fear was followed by speculative buying, reflecting shifting optimism for recovery.

- Market Sentiment: The prevailing sentiment among market participants constantly shifts between bullish optimism and bearish pessimism, influenced by economic changes, capturing the essence of collective investor behavior.

- Psychological Influences: Many investors likely faced inner conflict during the last financial crisis: their analytical instincts battling their basic fears. Factors such as overconfidence and loss aversion play a crucial role in shaping investor behavior, especially during volatile market phases. For a deeper dive into the impact of cognitive biases on trading decisions, How Cognitive Biases Affect Trading Decisions provides valuable insights.

- Market Indicators: Tools like the Fear and Greed Index and the Volatility Index (VIX) provide essential insights into investor sentiment, signaling potential market changes. CNN Business (2021) explains that the Fear & Greed Index is designed to reveal the current market sentiment based on various indicators, helping investors assess the general level of risk or opportunity in the market. This index serves as a barometer for understanding the prevailing emotional climate, assisting investors in making informed decisions during turbulent times. Furthermore, understanding economic factors is critical for grasping market sentiment; thus, check out How Economic Indicators Affect the Stock Market.

Behavioral finance acts as a shining lighthouse, guiding investors through choppy waters of irrationality that often obscure clear financial decision-making. This framework underscores the importance of psychological influences that frequently deviate from traditional financial models, advocating for a blend of psychological insights within sound investment strategies.

Numerous studies have confirmed the strong connection between emotional sentiment and market fluctuations, showing that heightened emotional states may signal significant market movements. Research indicates that during periods of market volatility, a hypothetical group of investors tends to react together, influenced by collective fear.

III. Methodology

Guided by a qualitative approach, this study emphasizes historical case studies that demonstrate how fear and greed have shaped investor behavior across various contexts. Consider a scenario where historical market analyses reveal patterns; these insights serve as a beacon for investors facing uncertainty. The insights drawn from these analyses can provide invaluable perspectives on current sentiment dynamics.

Our research will involve a diverse set of data sources, including financial news articles, investor sentiment surveys, and social media insights, to thoroughly capture the emotional climate affecting investors. Envision a financial analyst poring over sentiment surveys while integrating social media signals, piecing together the emotional narrative of the market. For readers keen on honing their analytical skills, linking to How to Analyze a Company’s Financial Statements for Investment Decisions could be beneficial in understanding investment dynamics.

Through comparative analysis, we will scrutinize historical events marked by significant shifts in sentiment, aiming to uncover relationships between emotional dynamics and observable market behavior. By treating emotions as economic indicators, we can unlock the intricate dance of sentiment and market dynamics.

IV. Analysis

- Understanding Fear and Greed: Market volatility can amplify emotional responses, impacting trading strategies. Grasping the fear-greed spectrum is essential; it enables investors to identify lucrative investment opportunities while maintaining emotional balance. Imagine a typical trader grappling with panic during a sudden market downturn; their decision-making is influenced by the hidden forces of fear and desire. Balancing the fear-greed spectrum is a financial tightrope walk, demanding stability and strategy. For those new to investing, Understanding Trading Psychology: A Beginner’s Guide can provide foundational insights.

-

Cognitive Biases: The herd mentality can lead investors to imitate popular trends, often straying from rational financial reasoning, which can undermine investment success.

-

Application of Sentiment Indicators: The effectiveness of the Fear and Greed Index reveals prevailing emotional currents within the market and helps in identifying favorable entry and exit points for investments. Utilizing sentiment indicators functions like having a financial weather vane—essential for predicting market direction. As a savvy investor, utilizing this tool can assist in aligning strategies with overall market sentiment.

-

Limitations of Market Sentiment Tools: While sentiment measures are useful, they can sometimes lag or be inaccurate. Therefore, adopting a cautious and informed perspective when integrating these indicators into investment strategy is important.

-

Patterns and Trends: Research suggests that episodes of extreme fear often uncover valuable recovery opportunities, while rampant greed can precede market corrections. Historically, a pattern emerges where a sharp market decline often sparks a surge of buying activity driven by fear of missing out. For those interested in a deeper historical context, The History of the Stock Market: Key Milestones provides a comprehensive overview.

-

Emerging Trends: The growth of social media and digital platforms has dramatically changed how sentiment is measured, leading to quicker emotional responses that can significantly impact market volatility.

-

Case Studies: An examination of key market events showcases not just numbers, but the human emotions that drive them. A comprehensive examination of significant moments reveals how the mix of fear and greed shapes investor behavior and broader market trends.

- Lessons Learned: Every case study is a chapter in a larger book of market psychology, revealing how fear and greed interact in shaping financial landscapes. Insights gained from our analysis can inform modern investment strategies, reinforcing the crucial role of understanding these psychological currents in influencing financial outcomes.

V. Ethical Considerations

Recognizing the challenges facing retail investors during market volatility is essential. Consider a financial advisor who skillfully guides a novice through turbulent waters, teaching them to interpret the emotional currents. By providing ethically sound financial advice, advisors can empower clients to confront these emotional challenges with confidence.

In the current market, misinformation acts as a fog, clouding clear visibility and understanding, complicating the path for investors. Financial professionals must advocate for critical thinking and transparent analysis to help clients maneuver the intricate web of market dynamics.

VI. Conclusion

In summary, this comprehensive exploration of fear and greed reveals their deep connections with market dynamics. Picture a seasoned investor reflecting on their journey; they recognize the shadows of fear and greed that have influenced every pivotal decision. Understanding sentiment is particularly crucial during periods of volatility, as psychological impulses can deeply affect investment decisions.

- Recommendations:

- Strategies for Individual Investors: Adopting a disciplined investment approach is like constructing a strong financial bridge—from analysis to execution. This disciplined approach that incorporates sentiment analysis into fundamental evaluations boosts decision-making capabilities. Insights from The Importance of Discipline in Successful Trading can further enhance trading practices.

- Ongoing Education: Visualize investors methodically educating themselves, armed with knowledge—strengthening their resilience against market fluctuations. Continual education about market dynamics helps adeptly manage the emotional turbulence linked to fear and greed. To kickstart learning, consider Investing 101: What You Need to Know Before You Start, which provides foundational knowledge for beginners.

Future investigations should explore the lasting effects of prevailing sentiment on market practices, especially regarding cultural differences in interpreting fear and greed. Imagine a researcher uncovering cultural variations in market sentiment; such insights could reshape conventional investment wisdom.

By harnessing the knowledge presented in this analysis, individuals can proactively initiate a financial journey that emphasizes growth and resilience.

References

Baker, M., & Wurgler, J. (2007). Investor sentiment in the stock market. Journal of Economic Perspectives, 21(2), 129-152.

CNN Business. (2021). Fear & Greed Index. Retrieved from https://money.cnn.com/data/fear-and-greed/

Schiller, R. J. (2000). Irrational Exuberance. Princeton University Press.

Tversky, A., & Kahneman, D. (1974). Judgment under uncertainty: Heuristics and biases. Science, 185(4157), 1124-1131.