I. Introduction

A. Background Information

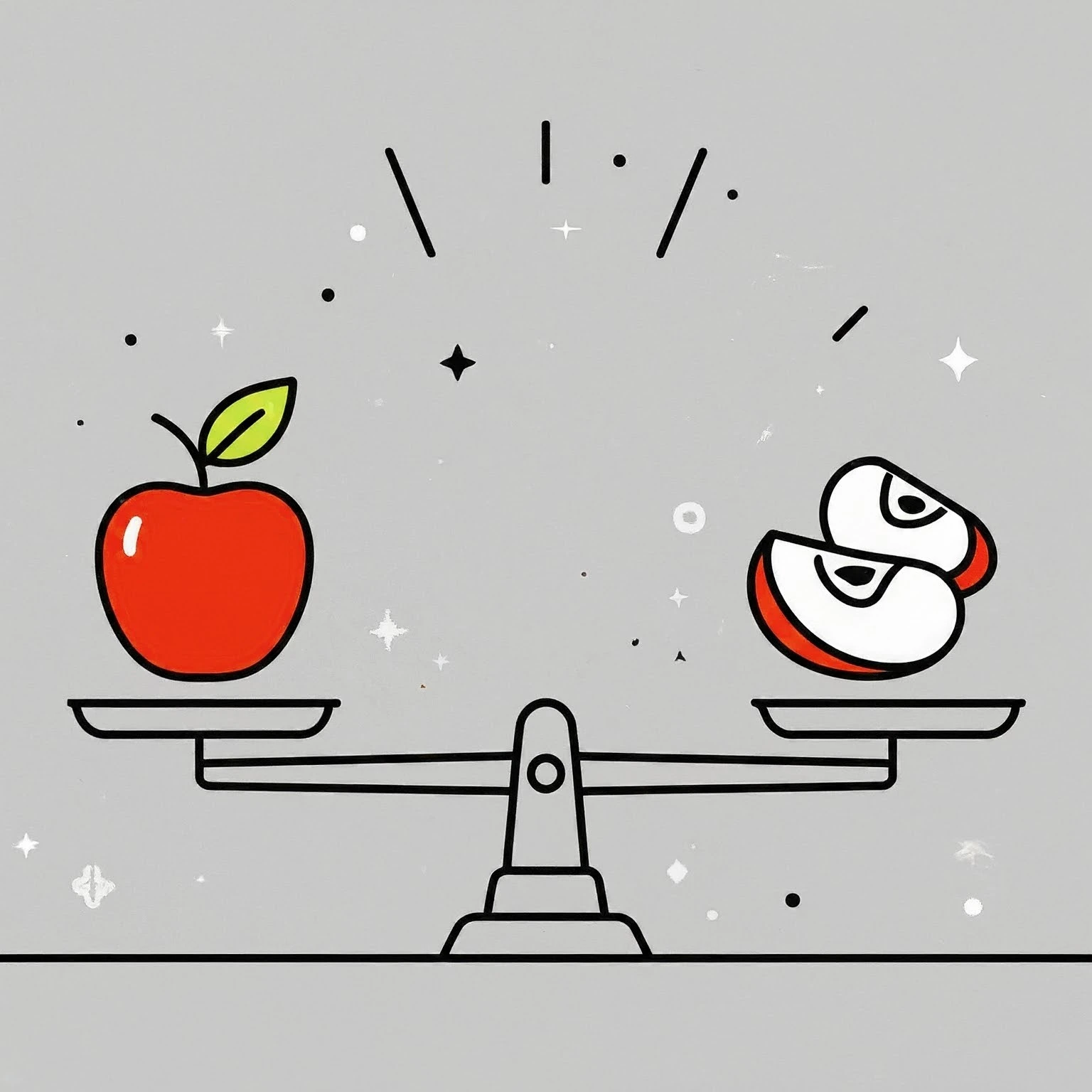

If you’ve ventured into the intriguing world of the stock market, you've surely encountered the term "stock split." To invigorate this introduction, it is essential to define stock splits clearly. At its core, a stock split occurs when a company divides its existing shares into multiple shares, enhancing liquidity without altering its overall market capitalization. For instance, in a 2-for-1 stock split, if you owned a share priced at $100, you would now hold two shares valued at $50 each—your total investment remains unchanged. Much like discovering an unexpected gem in a vast mine, many investors find themselves exhilarated by the prospect of new opportunities. This strategic move primarily aims to improve liquidity, lower the entry price for new investors, and signal a company’s growth ambitions. Understanding the mechanics behind stock splits is essential for making informed decisions that can significantly impact your portfolio. For those new to investing, exploring the foundational concepts can be particularly beneficial; we recommend checking out our resource on Investing 101: What You Need to Know Before You Start.

B. Relevance to Stock Market Investors

The stock trading landscape has witnessed major changes, particularly driven by recent global events that sparked retail investments through accessible online trading platforms. Trying to understand the stock market without a grasp of stock splits is like sailing a ship without a compass—uncertain winds could lead to unexpected detours. Notably, high-growth companies like Tesla and Apple have utilized stock splits to draw in a wider range of investors. These corporate actions not only lower share prices but also resonate with a new generation eager to invest. Research shows that stock splits often generate increased investor interest, prompting significant price movements and heightened trading volume. This outcome is especially relevant for those looking to take advantage of market momentum and sentiment. Staying informed about these trends is key for recognizing and seizing emerging opportunities in the market. To deepen your understanding, consider exploring the implications of market cycles through our article on Understanding Bull and Bear Markets: What They Mean for Investors.

C. Thesis Statement

This essay will examine the intricacies of stock splits, analyze their effects on investors, and illustrate how, despite generating immediate excitement, their lasting impact is fundamentally tied to the long-term performance of the involved companies.

II. Literature Review

A. Historical Context

The practice of stock splits has a long history, going back to the early 1900s, and has become more common as market practices continue to change. The rise of stock splits in the current market shows evolving corporate strategies. Significant events, such as Apple’s 4-for-1 split and Tesla’s 5-for-1 split in 2020, received considerable media coverage, underscoring the strategic reasons behind these corporate actions.

B. Current Trends in Stock Splits

Especially within the technology sector, consider the wave of investor enthusiasm that surged when high-growth tech companies decided to implement splits as a strategic choice. Stock splits are an effective tactic to draw in retail investors. Companies often carry out splits as a sign of their growth hopes, making this method common during bullish market periods. By understanding these trends, valuable insights can be gleaned for potential investment opportunities. As you examine these changes, it can be useful to understand broader market dynamics, as highlighted in our resource on The Future of the Stock Market: Trends to Watch.

C. Prior Research Findings

Interestingly, research consistently shows that stock splits often attract increased investor interest. According to Loughran and Schultz, the findings indicate that stock splits lead to a notable rise in trading volumes and stock prices. The boost in liquidity and the perception of enhanced value greatly shape overall investor sentiment, affecting both immediate trading actions and longer-term investment strategies.

III. Understanding Stock Splits

A. Definition and Mechanisms

Stock splits primarily come in two forms:

- Forward Split: This increases the total number of shares while decreasing the share price. A forward split results in a lower price per share, yet the investor's value remains stable—a crucial aspect of stock market dynamics. For example, in a 2-for-1 split, your number of shares doubles, but each share is worth half the price.

- Reverse Split: In contrast, this decreases the number of shares while increasing their price—such as a 1-for-5 reverse split.

Regardless of the type, the company's total market capitalization remains steady immediately following this action. However, the increased availability of shares usually boosts liquidity and trading activity—factors you’ll want to watch closely when crafting your investment strategies. The reduction in share price not only makes the stock more affordable but also tends to generate increased interest among smaller investors who might otherwise be blocked from the market. To fully grasp the implications of stock splits, it’s essential to understand their relationship to market fundamentals, which is why we recommend reading about Understanding Market Capitalization: What It Means for Investors.

B. Psychological Impacts on Investors

Grasping the psychological factors linked to stock splits is crucial. Many investors are quick to act when the post-split prices look appealing, which can lead to decisions that may not be entirely rational. After a split, many investors could see the now-lower prices as a more approachable entry point, leading to a spike in buying activity. Insights from behavioral finance suggest that perceived affordability can deeply sway investment choices, sometimes overshadowing more comprehensive analytical assessments. For a deeper dive into this behavioral aspect, our article on The Impact of Emotions on Trading Decisions offers valuable perspectives.

IV. Methodology

A. Research Design

This analysis takes a mixed-methods approach, merging qualitative insights from literature with quantitative assessments of stock performance data related to major stock splits. The research design serves as a blueprint, guiding the exploration into the complex nature of stock splits and their influence on investor behavior.

B. Data Collection

Data will be gathered from reputable financial sources such as Bloomberg and Yahoo Finance. Investors, similar to explorers charting new territories, depend on the latest data and insights to understand their investment landscapes. Additionally, interviews with experienced investors and financial analysts will further enhance our grasp of market sentiments surrounding stock splits. An emphasis on continuous learning will act as a crucial pillar for any effective investment strategy. This concept is thoughtfully explored in our article, The Importance of Staying Informed in the Stock Market.

C. Analytical Techniques

Our analysis will feature statistical evaluations of stock prices prior to and following splits, along with an assessment of public sentiment drawn from discussions on social media and coverage in leading financial publications.

V. Analysis

A. Short-term Impacts of Stock Splits

Case studies from industry leaders like Tesla and Apple show examples of positive price movements and increased trading volumes immediately after their splits. Price trends following stock splits are oftentimes temporary, highlighting the need for careful strategic engagement. Empirical evidence backs the notion that investor enthusiasm tends to rise during these corporate choices, creating openings for strategic actions. Nonetheless, while many investors may respond positively at first, it remains important to keep an eye on foundational factors that influence long-term performance.

B. Long-term Performance Post-Split

While short-term price rises after splits are common, the connection between splits and long-term performance is more complex. An experienced investor remembers how the initial excitement from a split usually gives way to more profound factors that determine the true value of the stock. As Grinblatt and Hwang point out, while stock splits come with immediate price bumps, the long-term performance involves complexities that warrant detailed examination. Excitement may lead to volatility, affecting buying and selling choices, so an over-reliance on splits could obscure judgments regarding actual valuations—an important risk to keep in mind. To sharpen your stock assessment abilities post-split, consider reading our guide on How to Evaluate a Company Before Buying Its Stock.

C. Investor Behavior and Response

Retail investors often react emotionally to stock price changes following splits. This reaction stands in stark contrast to institutional investors, who generally rely on long-term fundamental analysis rather than fleeting price fluctuations. The actions of retail investors are often shaped by the perceived excitement surrounding stock splits, potentially resulting in short-term spikes that may not always align with the company's true value.

VI. Discussion

A. Implications for Investors

By exploring the various aspects of stock splits, informed investment decisions can be made. A sensible approach to stock splits not only opens up possibilities but also reduces the emotional ups and downs tied to market fluctuations. While splits can reveal attractive prospects, being aware of the inherent risks and preparing for emotional responses will form a strong base as you shape your investment journey. It’s important to keep in mind that no universal strategy fits all situations, and past performance cannot predict future results.

B. Ethical Considerations

Transparency regarding the reasons behind stock splits is essential. Just as a lighthouse steers ships through fog, clarity from companies about their motives ensures investors don't find themselves lost in confusion. Companies should maintain clear communication with investors to avoid misunderstandings or possible mistrust. In this context, understanding the role of corporate governance can provide valuable insights. For further reading, our article on Understanding the Role of Corporate Governance in Fundamental Analysis can offer a deeper perspective.

VII. Conclusion

A. Summary of Findings

In summary, stock splits act as influential events, altering liquidity dynamics and significantly affecting investor sentiment. Stock splits are catalysts for increasing liquidity and broadening investor interest, fundamentally altering the landscape for engaged market players. However, it is crucial to remember that the wider implications rely more significantly on the underlying performance of the companies than on fleeting market excitement. Investors need to find a balance between the immediate appeal of a lower share price and the importance of carefully evaluating long-term performance indicators.

B. Future Research Directions

Looking ahead, market analysts frequently ponder how unexplored aspects such as investor psychology could unfold as a new chapter in an ongoing narrative. Investigating the psychological factors that shape investor reactions to stock splits—especially among younger demographics—offers a promising path for future research. Further, exploring variances across different sectors and economic scenarios could provide deeper insights into the role stock splits play in the current market.

VIII. References

- Grinblatt, M., & Hwang, C. (1989). Signaling and Reputation: The Role of Stock Splits. Journal of Finance, 44(1), 39-46.

- Loughran, T., & Schultz, P. (2004). Pitfalls of Using Chemists' Returns for Shareholder Wealth Effects. Journal of Finance, 59(2), 1003-1014.

- Malkiel, B.G. (2004). A Random Walk Down Wall Street: The Time-tested Strategy for Successful Investing. W.W. Norton & Company.

- Investopedia. (n.d.). Stock Split Definition. Retrieved from https://www.investopedia.com/terms/s/stocksplit.asp