I. Introduction

A. Background and Context

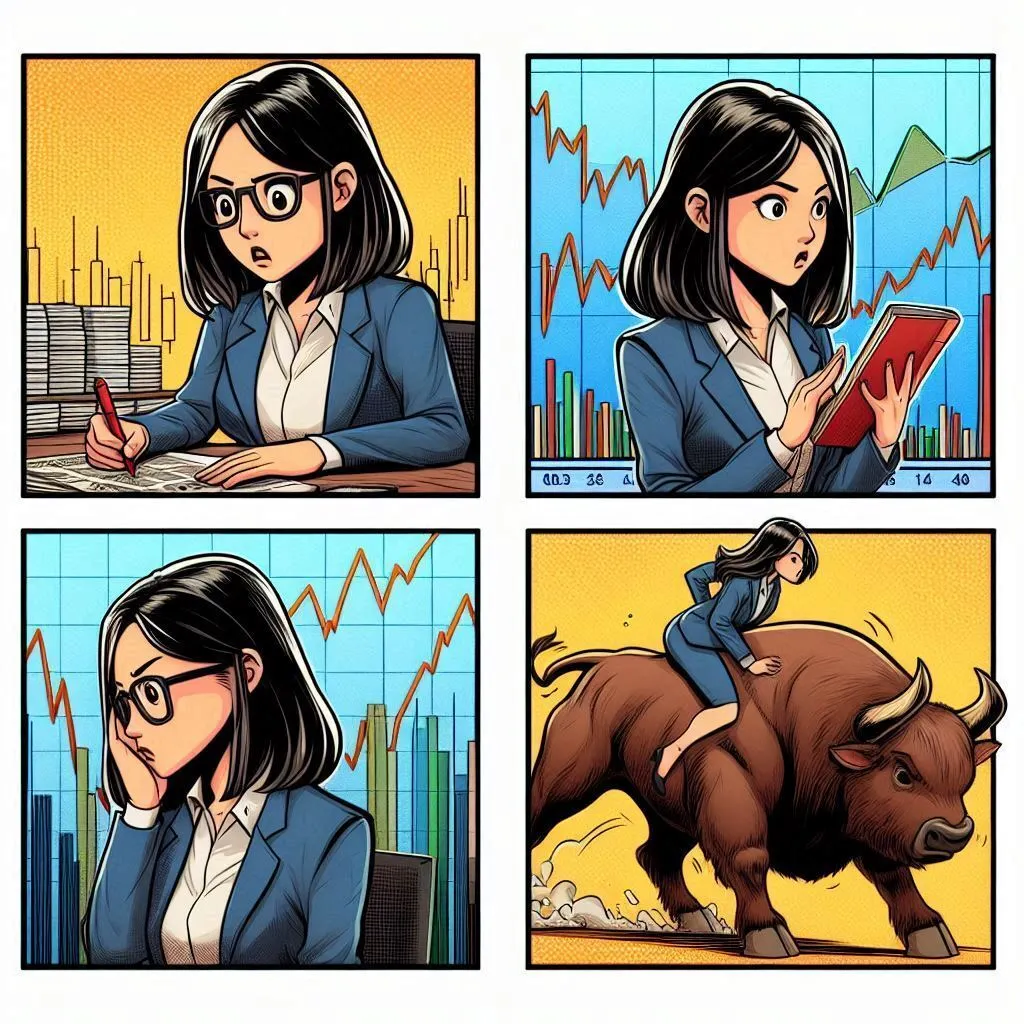

Imagine standing in the heart of a lively marketplace where prices fluctuate and countless choices abound. Just like that vibrant setting, the stock market operates dynamically, with brokers acting as your guides, helping you through the challenges of buying and selling securities. In our fast-changing investment landscape, especially as we transition from traditional trading floors to cutting-edge digital platforms, it’s crucial to understand how the role of brokers is changing—especially for informed investors who want to maximize their financial growth. The brokerage industry has seen major shifts, mostly due to technology that has moved the focus from traditional trading environments to digital platforms. For instance, think about an investor who successfully evaluated their choices of brokers and gained significant benefits, showing that investment results can greatly vary based on the selected broker. To further enhance your understanding of these dynamics, you might find it useful to read about How Does the Stock Market Work? Simplified Concepts for Beginners.

B. Rationale for the Study

With technology making trading as simple as a tap on your smartphone, the lines between accessibility and responsibility have blurred. By diving deep into the roles and responsibilities of brokers, you’ll be empowered to make informed investment decisions that sync with your long-term financial goals. Brokers serve as essential guides in the stock market, assisting investors in making informed decisions amid the challenges of trading securities. A solid grasp of various brokerage services will give you the confidence to manage your investment journey. For foundational insights, consider exploring our article on Investing 101: What You Need to Know Before You Start.

C. Research Questions

This guide addresses three pivotal questions designed to enhance your understanding:

1. What are the main functions and responsibilities of brokers in the current stock market?

2. How do technological innovations and regulations shape the relationship between brokers and investors?

3. What risks and ethical issues should you consider while using broker services?

II. The Evolution of Brokerage

A. Historical Perspective

Like the move from horse-drawn carriages to electric vehicles, the brokerage industry has evolved with technological advancements, undergoing significant changes since it began in the 17th century when trading was mainly handled by merchants and representatives. Notable institutions like the Amsterdam Stock Exchange and the New York Stock Exchange (NYSE), established in 1792, laid the groundwork for modern brokerage practices. Recently, the internet has dramatically changed this landscape, leading to digital trading platforms and discount brokers—great for self-directed investors who want to manage their financial futures. The rise of commission-free trading has made market access more universal, enabling more investors to join the stock market without high costs. Zero commission trading has notably lowered market entry barriers, creating a more inclusive investment environment for different types of investors. The Crash of 1929 serves as a reminder of how broker practices have evolved in response to market fluctuations, further showing the industry's transformation. To gain more historical context on brokerage practices, I recommend reading The History of the Stock Market: Key Milestones.

B. Broker Types and Services

Choosing the right broker is crucial and can greatly shape your investing experience. Here’s a summary of the main types of brokers available to you:

-

Full-Service Brokers: These professionals provide a wide array of investment strategies and personalized portfolio management. If you appreciate tailored guidance and insights and don’t mind paying higher fees for that special attention, a full-service broker might be your best option.

-

Discount Brokers: If you feel confident managing trades independently, discount brokers offer a cost-effective choice. They provide essential services at lower fees with limited personalized support, appealing especially to analytical investors who prefer self-directed approaches, allowing you to save on costs while actively managing your investments. Additionally, understanding basic concepts like Market Capitalization is essential, as it informs you of the market dynamics relevant to broker decision-making.

-

Robo-Advisors: These automated platforms blend technology with investment management, creating diversified portfolios suited to your risk tolerance and financial goals. Picking a broker is like choosing a type of cuisine; some offer detailed recipes with full-service options, while others provide the basic ingredients for you to create your own dishes. If you’re part of the younger generation seeking efficiency without sacrificing quality, robo-advisors could be a great fit.

C. Current Trends

The brokerage landscape is experiencing a significant shift, especially with the growth of commission-free trading. Apps like Robinhood and E*TRADE have made market access more affordable and reachable than ever. A key example was the GameStop trading frenzy in early 2021, which highlighted the increase in retail investor participation and trading volume, showcasing the growing influence of individual investors in the market.

D. Regulatory Framework

As you explore the market, it’s important to understand the strict regulations governing brokers, set by organizations like the SEC (Securities and Exchange Commission) and FINRA (Financial Industry Regulatory Authority). These rules ensure fair practices and protect investors. Getting to know key laws, such as the Investment Advisers Act and the Dodd-Frank Act, will clarify brokers’ duties to act in your best interest. To understand how these regulations affect your broker interactions, you might want to read about The Role of Stock Exchanges: NYSE vs NASDAQ.

III. Broker Functions and Services

A. Execution of Trades

At the core of broker functionalities lies trade execution. Full-service brokers often focus on providing personalized experiences, while discount brokers prioritize efficiency and cost-effectiveness. Knowing how trade execution works is crucial to optimizing your strategies, helping ensure you get the best possible results for your investments.

B. Advisory Services

Brokers provide varying levels of support tailored to your needs. Full-service brokers give detailed market analysis and customized investment advice. In contrast, discount brokers usually take a more general approach, offering less hand-holding along the way. Evaluating what level of support fits your investing style is important as you progress.

C. Technological Impact

The rise of self-directed investing has been significantly driven by technological advancements. The growth of digital platforms has enabled investors to carry out trades on their own, reducing reliance on traditional brokerage firms. Robo-advisors are a clear example of this trend, providing an effective method of investment management that attracts those wanting to simplify their portfolios without losing performance.

D. Ethical Considerations

While brokers offer many advantages, the industry faces ethical challenges, especially potential conflicts of interest. Such issues can arise when brokers advocate for commission-driven products that might not be in the best interests of clients. Upholding fiduciary duty is vital for maintaining trust in the investor-broker relationship; a broker's main responsibility should always be to you as the investor.

E. Effects of Regulation

In recent years, rule changes have reshaped broker operations. For example, the fiduciary rule requires brokers to prioritize their clients’ interests, while transparency initiatives about fees help you make informed investment choices. This regulatory environment reinforces the need for brokers to clearly communicate their services and any associated costs.

IV. Implications for Investors

A. Broker Selection

As an informed investor, grasping the different roles brokers play is crucial for making the best choice that fits your investment strategy. Whether you choose the comprehensive support of a full-service broker or the independence of a discount option, recognizing your investment needs is vital for success in the market.

B. Comprehensive Evaluation

Picking a broker calls for careful evaluation. Look into service offerings, closely inspect fee structures, and be aware of potential conflicts of interest. This thorough examination can lead to favorable investment outcomes in the long run, empowering you to tackle the challenges of trading with confidence. A general example of an investor who succeeded by diligently comparing broker fees and services highlights the value of thorough evaluation.

C. Addressing Knowledge Gaps

Consider this guide a stepping stone toward a deeper understanding of brokerage services. By broadening your knowledge of recent regulatory changes and the effects of technology on investment strategies, you can strengthen your connection with the financial markets and make informed choices about your portfolio.

V. Conclusion

A. Recap of Broker Significance

In summary, brokers are more than just facilitators of stock transactions; they are key partners influencing your investment path. Brokers guide your investment journey, highlighting their essential role in the complex world of financial markets. As the market continues to evolve due to technological progress and regulatory changes, the need for trust and transparency in your connections with brokers is vital. The role of brokers as guides in the challenges of the stock market reinforces their importance in helping you achieve your investment objectives. To further comprehend the role of brokers, consider reading about The Importance of Diversification in Stock Investing.

B. Future Directions for Research

Looking forward, enhancing our knowledge of fintech trends and their effects on brokerage services is important. Also, examining investor behaviors amid these changes will give insight into the dynamic world of investing and how it impacts decision-making. Examples where investors increased their returns by using a broker’s insights underline the importance of trust and transparency in this relationship.

As you learn about the essential roles brokers play in financial markets, you’re empowering yourself to approach the challenges of stock trading with greater confidence. This foundational knowledge fosters informed decision-making, steering you toward a successful financial future in the current investment environment.

References

- Acuña, A., & Wong, R. (2020). The Impact of Zero Commission Trading in the Market: A Case Study. Journal of Financial Economics, 137(2), 304-325.

- Devenow, A., & Welch, I. (1996). Rational Herding in Financial Economics. European Economic Review, 40(3-5), 603-615.

- Paredes, T. A. (2017). The Anxiety of Influence: Understanding the Securities Market. Virginia Law Review, 103(6), 1583-1611.