Introduction

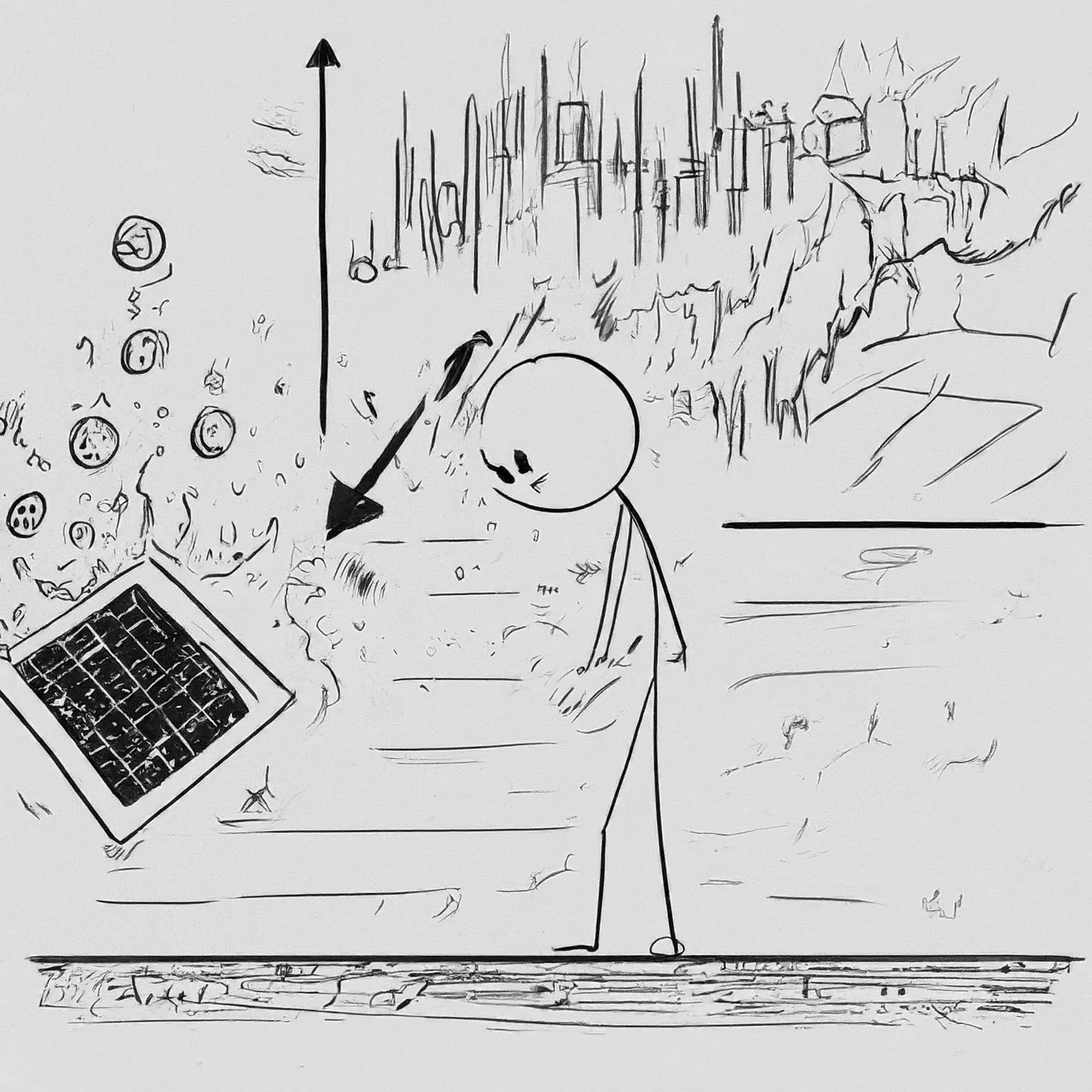

If you've ever experienced the excitement of watching stock prices increase or the anxiety of seeing them decrease, you understand the lively movement of financial markets—where the bull and bear each make their presence felt. Imagine a young worker, eager to secure their financial future, fixated on their screen, observing the stock market change; their heart beats faster with the numbers. Envision a crowded stadium filled with energy as the home team scores the final touchdown—that represents a bull market, defined by positivity, increasing stock prices, and strong economic conditions. Now, picture the quiet of a sparsely filled arena where hope fades; that portrays a bear market, characterized by dropping prices and widespread doubt. For those looking to improve their financial knowledge and make informed investment choices, grasping these market dynamics is crucial. In simple terms, a bull market is when stock prices rise by 20% or more from recent lows, often occurring alongside a strong economy, low joblessness, and increased consumer confidence. On the other hand, a bear market shows a decline of 20% or more from recent highs, signaling economic troubles and increased pessimism among investors (Schiller, 2019). This underscores how bear markets frequently align with larger economic declines, creating a backdrop of uncertainty for investors.

This essay will examine these market cycles, provide historical context, identify key economic indicators, and explore the psychological elements that affect investor behavior. By the conclusion, you’ll have useful insights to guide your investment strategies effectively, whether the market is on the rise or decline.

Understanding Market Cycles

Historical Context and Definitions

The words "bull" and "bear" refer to the different fighting styles of these animals—bulls lift their horns up, while bears swipe down with their paws. This imagery vividly depicts market fluctuations—a theme highlighted by iconic investors such as Benjamin Graham and Warren Buffett. When we look at past patterns, it’s clear that market cycles are closely linked with broader economic signals. During the dot-com boom, for example, investors rushed to tech stocks like bees to flowers, only to face a severe downturn as prices fell. Such market actions often mirror investor sentiment; during times of high optimism, people are more likely to invest heavily, driven by feelings of greed and the fear of missing out (Barberis & Thaler, 2003).

The COVID-19 pandemic triggered one of the quickest bear markets ever, showcasing the unpredictable nature of financial markets and emphasizing the need for data-focused investment choices. Market cycles resemble the changing seasons; just as winter inevitably turns to spring, bear markets must eventually give way to the robust rise of bull markets.

Key Economic Indicators

Comprehending key economic indicators empowers you, as an investor, to actively adjust your portfolio. Let’s examine these vital indicators:

- GDP Growth: Strong economic growth generally coincides with bull markets, showing favorable conditions for investing.

- Unemployment Rates: A reduction in unemployment usually points to upward market trends, while rising unemployment can signal upcoming bear markets.

- Consumer Confidence Index (CCI): This index gauges consumer attitudes and spending patterns, which can directly impact market outcomes.

By carefully tracking these indicators, you can enhance your investment strategy and exercise more control over examining market fluctuations. It's essential to understand that while these indicators offer valuable insights, they don’t guarantee future performance; therefore, diversifying your analysis is important.

The Psychological Aspect of Investing

Human Behavior in Market Cycles

Investor psychology significantly influences market movements. Our feelings often drive our financial choices, sometimes in surprising ways. The well-known concept of loss aversion indicates that losses tend to affect us more emotionally than equivalent gains, which can worsen panic selling during bear markets, causing prices to drop further (Kahneman & Tversky, 1979). This psychological aspect reveals why many investors sell out of fear during declines, concentrating on losses instead of potential rebounds.

In bull markets, the fear of missing out (FOMO) can lead to rash buying, driving up asset prices substantially. Conversely, in bear markets, fear may lead to widespread selling, worsening losses. During the 2008 financial crisis, many investors felt the anxiety of watching their portfolios shrink, serving as a stark reminder of market volatility. Understanding these psychological aspects is critical since emotions like fear and greed play a vital role in shaping investor attitudes, affecting market trends, and often resulting in hasty trading actions (Barberis & Thaler, 2003).

Key Psychological Factors: - Fear and Greed: These intense emotions can upset logical decision-making and lead to swift reactions to market changes. - Loss Aversion: As mentioned earlier, the psychological discomfort associated with losses often leads to quick selling actions during dips, perpetuating a cycle of falling stock prices (Kahneman & Tversky, 1979). - Overconfidence: Investors frequently feel invulnerable during rising markets, which can lead to higher risk exposure and lapses in caution.

Even experienced investors can fall victim to these psychological pitfalls. Developing self-awareness, alongside a commitment to lifelong learning, is key to building strong investment practices. It’s essential to remember that investment plans should be customized to personal needs, as no single solution works for every investor.

Investment Strategies in Different Market Conditions

Strategies for Bull Markets

During rising markets, adopting certain strategies can be particularly advantageous. Here are a few tactics you might consider:

- Growth Investing: Focus on companies expected to greatly outperform their rivals. Investors who identified emerging tech leaders during the last tech boom gained significant rewards.

- Sector-Focused Strategies: Pay attention to sectors likely to thrive in positive economic environments, such as technology or consumer services, revealing potential investment possibilities.

Responding to Bear Markets

As conditions change, adjusting your investment approach is critical to protecting your resources. Following the 2008 recession, astute investors turned to conservative strategies, focusing on stability instead of high-risk options. Here are some effective tactics:

- Defensive Investing: Prioritize sectors such as utilities or consumer essentials, which usually offer greater stability during economic slowdowns.

- Hedging Strategies: Consider using options trading or protective actions like stop-loss orders to protect profits and lessen potential losses (Black & Scholes, 1973). Investors often employ these strategies during bear markets as methods to limit possible capital losses, demonstrating a realistic response to shifting market conditions.

Keep in mind, investment strategies should be adaptable. While historical trends can offer insights, recognizing that market situations can change is vital. Tailoring your strategies to fit current realities ensures that your portfolio remains strong and positions you for the best outcomes.

Ethical Considerations in Investing

Approaching investments without ethical considerations is like steering a ship without a compass; without direction, one risks losing their way in stormy seas. Being aware of possible conflicts of interest is crucial for the success of your investment plan.

Conflicts of Interest

A common issue arises when financial advisors recommend products based on personal commissions rather than putting your best interests first. A recent study showed that many investors unknowingly followed advisors who directed them toward high-commission products instead of focusing on their needs. To reduce this risk, engage in independent research and commit to continuous learning, empowering you to make informed investment decisions.

Cultivating Responsible Practices

Integrating ethics into your investment plan not only improves your chances for lasting success but also fosters a more trustworthy environment. Encourage transparency in your decision-making and develop a solid understanding of your risk tolerance; these practices lead to sustainable financial results and protect your investments.

Areas for Further Research

The constantly changing landscape of bull and bear markets offers ongoing learning opportunities:

- Global Influences: Explore the intricate link between global factors and local market conditions.

- Technological Changes: Stay informed about new technologies—like cryptocurrency and algorithmic trading—to anticipate shifts and understand their effects. Embracing this understanding allows investors to cultivate a wealth of knowledge, where each piece of information enriches their insight.

Conclusion

Understanding bull and bear markets is vital for understanding the complex financial landscape we encounter. Think of an investor who once struggled to grasp market cycles—after dedicating themselves to ongoing education, they entered the unpredictable waters of trading with a new sense of assurance. By mastering concepts, identifying key signals, and recognizing psychological factors, you’re on your path to creating effective investment strategies for both rising and falling markets. Ultimately, your dedication to lifelong learning and flexibility will act as your greatest allies in resilient investing. This thorough examination of bull and bear markets equips investors with essential tools. Embrace the knowledge you gain, stay adaptable amidst market shifts, and, with this solid foundation, you’ll not just endure but prosper in the investment world.

Key Insights for Investors

- Investment Foundations: Building a strong understanding of market definitions and historical trends is crucial for informed decision-making.

- Psychology of Investing: Acknowledging emotional influences can improve your capacity to make sound investment choices.

- Adaptive Strategies: Adjusting your strategies to current market conditions can boost returns while reducing risks.

- Ethical Investment: Emphasizing transparency fosters a sustainable and responsible investment environment.

This exploration of bull and bear markets provides you with the essential tools required to tackle financial complexities and instills the confidence needed for informed decision-making, empowering you as an investor through any market cycle. Remember, no strategy is foolproof; it's flexibility and continuous learning that set you up for success.

References

Barberis, N., & Thaler, R. (2003). A Survey of Behavioral Finance. In Handbook of the Economics of Finance, Vol 1. Elsevier.

Black, F., & Scholes, M. (1973). The Pricing of Options and Corporate Liabilities. The Journal of Political Economy.

Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica.

Schiller, R. J. (2019). Irrational Exuberance. Princeton University Press.

Hurst, B. (2021). Bull and Bear Markets: Characteristics and Implications for Investors. The Journal of Financial Economics.