I. Introduction

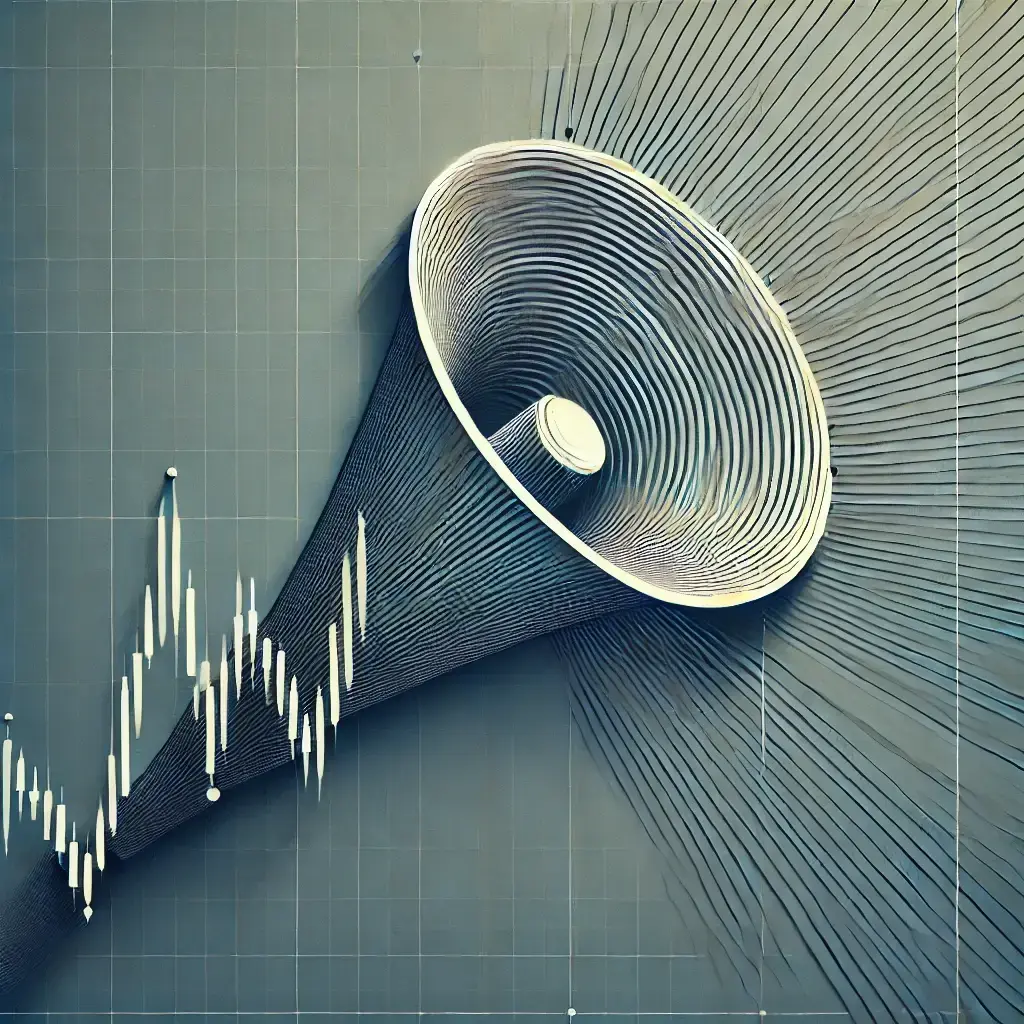

If you've ever looked at a financial chart and noticed price movements that form a shape similar to a megaphone or trumpet, you've encountered a broadening formation! During different market cycles, many traders have seen broadening formations while analyzing price movements on their charts. Later, they realize the opportunities these patterns offer in volatile times. These unique chart patterns are not just interesting to look at; they indicate higher market volatility and can signal possible price shifts. Broadening formations are specifically defined by a series of clear "higher highs" and "lower lows," which are important indicators for predicting market movements (Edwards & Magee, 2007, p. 123). The unique traits of these formations help traders respond effectively to changing market conditions, making them a key tool for traders. Broadening formations often appear during uncertain market periods, such as major economic events or political upheaval. This guide will help you explore the complex world of trading broadening formations.

To improve your understanding as you dive into this advanced trading method, you might want to first familiarize yourself with some basic concepts. For more information, you can look at Investing 101: What You Need to Know Before You Start, which offers essential investment knowledge.

II. Understanding Broadening Formation Patterns

A. Definition and Characteristics

Broadening formations happen when asset prices show significant changes, creating a noticeable structure of peaks (higher highs) and valleys (lower lows). Many experienced investors view broadening formations as important indicators in their trading toolkit, as they indicate increased market volatility (Rustam, 2019, p. 50). This striking pattern serves as a crucial sign, enabling you to anticipate potential market movements and decide if they indicate a reversal or continuation of the current trend. Recognizing these patterns can lead to more informed trading choices, particularly during times of high volatility. For those wanting to expand their knowledge, Chart Patterns: How to Identify and Use Them in Trading is a great resource for understanding a range of chart patterns, including broadening formations.

B. Historical Context

The basis of broadening formations is rooted in technical analysis principles, with insights from early analysts like Charles Dow and Richard Wyckoff. The innovators of technical analysis have laid the foundation for modern trading, weaving a tapestry of knowledge that traders incorporate into their strategies. Neill (2014) noted that "the foundational principles of technical analysis established by Dow and Wyckoff highlight the importance of broadening formations in understanding market psychology" (p. 98). Over the years, analysts have found patterns in price movements that reflect market psychology. Understanding these patterns can enhance your trading strategies and develop a deeper grasp of market behavior, which is a crucial skill in the fast-paced financial world.

C. Current Trends in Trading

As algorithmic trading becomes more common, quickly spotting broadening formations is essential. In the era of algorithmic trading, rapidly identifying broadening formations through advanced algorithms has become vital for improving trading choices during market volatility (Liew, 2021, p. 105). You now have access to advanced data analytics and tools that help you quickly spot these patterns, especially in tumultuous market conditions. In this digital trading environment, many traders struggle with the speed of technology while attempting to maintain accuracy in recognizing key patterns. Developing your analytical abilities in this context is crucial for trading success.

D. Key Literature

Reading classic texts such as John J. Murphy's Technical Analysis of the Financial Markets and Thomas Bulkowski's Encyclopedia of Chart Patterns can greatly enhance your understanding and improve your decision-making skills in trading. These important texts act as guides, illuminating the way to effective trading practices and grounding your strategies in historical knowledge.

III. Methodology

A. Research Design

This guide uses a mix of qualitative and quantitative research methods to study existing literature and relevant trading data about broadening formations. Many traders depend on a combination of qualitative and quantitative methods to refine their strategies. Practical case studies involving various asset types, including stocks and cryptocurrencies, will showcase the real-world application of recognizing and trading these patterns. For those wanting to grasp the basic elements better, the article on The Basics of Technical Analysis for Stock Trading offers a solid foundation.

B. Data Collection

To enhance your understanding, we will refer to trustworthy financial platforms and academic sources, using advanced charting software to identify historical examples. Traders often compare past price data to identify repeating patterns, which strengthens their comprehension and ability to make informed decisions. This multifaceted approach will enrich your understanding of how to effectively apply these concepts in various trading contexts. A great starting point is How to Read Stock Charts: A Beginner’s Guide, which can help you enhance your skills in data collection.

C. Analysis Techniques

We will apply statistical analyses and consider external factors that affect market behavior to assess outcomes linked to broadening formations. Historically, analysts have identified trends to assess the potential impact of external market influences. This careful analysis will refine your ability to interpret the performance of these patterns under different market conditions.

IV. Practical Insights into Trading Broadening Formation Patterns

A. Identifying the Pattern

Successfully trading broadening formations depends on recognizing their key features: a series of rising peaks and falling troughs over time. The unique traits of broadening formations, marked by fluctuating price points, can signal changes in market confidence, influenced by current investor sentiment (Edwards & Magee, 2007, p. 123). Many traders achieve success by integrating indicators with their visual assessments. Beyond simple visual checks, consider using technical indicators like the Relative Strength Index (RSI) and volume metrics to support your trades—this will help you feel more prepared and informed. Additionally, look at the article on Top 10 Technical Indicators Every Trader Should Know for useful tools that can assist you in spotting patterns.

B. Understanding Market Dynamics

The mindset of traders significantly influences broadening formations. The trading floor can often resemble a battleground, where emotions drive conflicts that shape market trends. Elements like fear, greed, and the need for confirmation can greatly affect price shifts, increasing volatility. Grasping these psychological factors aids traders in developing a more comprehensive approach to market analysis, improving their ability to handle the turbulent world of trading.

C. Effective Trading Strategies

Setting clear entry and exit points is vital for trading success. When you identify broadening formations, consider initiating trades when prices break through established resistance or support levels set by the pattern. Additionally, emphasize thorough risk management strategies—such as implementing stop-loss orders and establishing appropriate position sizes—to protect against unforeseen market changes. Traders frequently highlight the significance of establishing clear parameters to avoid the dangers of emotional trading, which is especially critical in the context of broadening formations where volatility is high.

D. Distinguishing from Other Patterns

Broadening formations are noticeable among numerous indicators, directing traders toward significant opportunities, particularly during periods of market volatility. While all patterns suggest potential trend reversals or continuations, the importance of broadening formations becomes especially sharp during times of increased instability, solidifying their role in your trading toolkit. Acknowledging this distinction is essential for traders seeking to effectively leverage market patterns.

V. Addressing Challenges and Limitations

A. Risks in Trading Broadening Formations

Even though broadening formations can be powerful tools, they carry inherent risks. Traders recognize the precariousness of misidentifying technical patterns. Misinterpreting these patterns or failing to recognize them correctly can result in significant losses, making caution essential. Remain attentive to common traps—like drawing hasty conclusions about a pattern's existence without sufficient evidence—and always take into account the wider market context, which might heighten your risks. For further insights on frequent mistakes, check Top Mistakes Beginners Make in the Stock Market.

B. Market Dynamics Affecting Reliability

The dependability of trades based on broadening formations can fluctuate in different market conditions. Market analysts have observed changes in reliability across various trading environments. Elements such as liquidity variations, overall market sentiment, and significant economic indicators can greatly influence reliability. Staying alert to these factors can refine your trading strategies and deepen your understanding of broadening formations. A helpful overview of these market dynamics can be found in Understanding Bull and Bear Markets: What They Mean for Investors.

VI. Opportunities for Further Research

A. Need for Empirical Studies

Consider this as a new area, ready for exploration by upcoming researchers. Ongoing empirical research is important to evaluate how successful trades related to broadening formations are across different asset classes. Such studies will clarify the links between these patterns and real market behavior, sharpening the analytical skills needed for trading success. Additionally, examining the role of economic indicators can provide more context; see The Role of Economic Indicators in Fundamental Analysis.

B. Expanding Educational Resources

Educational institutions are increasingly acknowledging the significance of comprehensive resources in fostering effective trading education. There’s a great chance to create extensive educational materials—like workshops and online courses—focused on improving traders' grasp of broadening formations. Engaging in simulated trading sessions can also offer valuable practice, allowing you to apply your skills before making real trades.

VII. Conclusion

A. Summary of Key Findings

This study emphasizes the value of broadening formations as tools for technical traders. These patterns offer crucial insights into market behavior, highlighting the complex interactions between psychological factors and macroeconomic influences. Many traders leave their studies with a refreshed sense of purpose and direction in their trading approaches.

B. Final Thoughts

Handling the constantly shifting waters of finance demands not only skill but also a steadfast commitment to ongoing learning. As financial markets change, traders who proactively adjust to variations in the market environment often find themselves ahead of others. By exploring the psychological and macroeconomic forces that drive market movements, you'll be well-prepared to tackle the challenging trading landscape.

In conclusion, a well-rounded grasp of broadening formations, combined with solid risk management and a strong awareness of market psychology, can greatly enhance your trading success. As an eager trader aiming to sharpen your skills and maximize profits, maintaining an informed and proactive mindset is crucial in a dynamic market setting. For more reading, consider The Importance of Staying Informed in the Stock Market to further boost your knowledge and decision-making abilities.

References

Edwards, R. D., & Magee, J. (2007). Technical Analysis of Stock Trends (10th ed.). Burlington, MA: Wharton School Publishing.

Liew, J. (2021). Algorithmic Trading and Market Efficiency: The Role of Pattern Recognition. Finance Research Letters, 38, 101420.

Neill, T. (2014). Charles Dow and the Development of Technical Analysis. Stock Market Education Journal, 12(3), 95-112.

Rustam, D. S. (2019). Technical Analysis Fundamentals and Market States. Journal of Economic Perspectives, 33(4), 45-62.