I. Introduction

A. Overview of Broadening Patterns

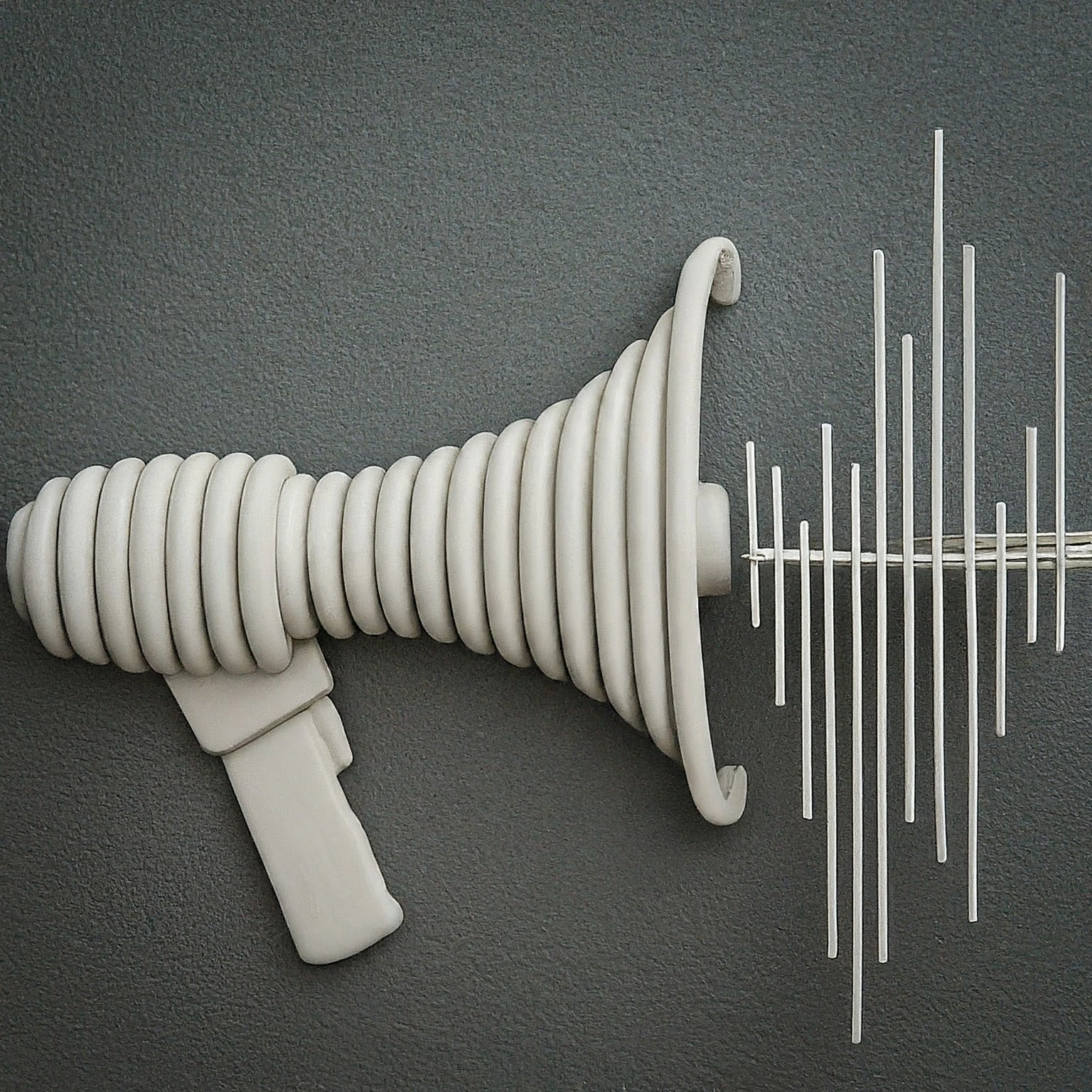

As a technical trader, you’re no stranger to the thrill and unpredictability of market movements. A broadening top usually appears at the peak of a bullish market, marked by higher highs and lower lows, often signaling a bearish reversal as upward momentum slows. In contrast, a broadening bottom forms at the end of a bearish trend, characterized by lower lows and higher highs. This pattern suggests reducing selling pressure, hinting at a potential bullish turn. Looking at a broadening top formation during a volatile market shows the collective insights that highlight the importance of these patterns for decision-making. According to Elder (1993), broadening formations often lead to reversals, where a broadening top points to a possible decline and a broadening bottom points to a possible rise. By mastering the recognition and details of these formations, one positions oneself to seize key market opportunities.

B. Purpose of the Article

This article aims to equip readers with practical insights to: 1. Identify and analyze broadening patterns effectively and improve trading strategies. 2. Explore the details of technical trading, enabling independent trading skills in the ever-changing financial markets. Pring (2002) states that understanding and analyzing patterns like broadening formations give traders essential skills to improve their strategic decisions, thus emphasizing the need to develop these analytical approaches.

C. Relevance to Technical Traders

This discussion focuses on the challenges faced daily, from managing market volatility to addressing the emotional issues of trading. By combining strong risk management techniques with detailed pattern analysis, the goal is to enhance trading skills, allowing quick responses to the market’s changing dynamics. Moreover, understanding the historical context of technical analysis enhances competence. Key figures like Charles Dow and Richard Wyckoff established the principles that form the basis of current trading theories, providing foundational knowledge crucial for modern traders (Neill, 2016). Additionally, reinforcing the importance of being informed is essential; learn more in The Importance of Staying Informed in the Stock Market.

II. Historical Context

Understanding the foundational principles of technical analysis enriches the trading approach. Looking back to the late 19th century when Charles Dow laid the groundwork for market behavior analysis, later expanded by Richard Wyckoff's thorough examination of price movements, traders depend on these principles for informed decision-making. Neill (2016) highlights that the foundations of technical analysis significantly rely on pioneers like Dow and Wyckoff, whose insights remain relevant for contemporary traders, reinforcing the value of historical knowledge in practical application. Broadening patterns are essential—not merely theoretical constructs; they act as crucial indicators of market behavior that informed traders use to gauge sentiment and refine daily trading strategies. For those interested in the development of market analysis, The History of the Stock Market: Key Milestones provides valuable insights.

III. Simplifying and Defining Key Concepts

A. Broadening Top and Bottom Patterns

At their core, broadening patterns represent a living entity with changing sentiments, showing collective judgments and reactions to patterns. Fischer (2011) notes that broadening patterns act as signs of the collective sentiment among traders, reflecting changes that often lead to significant market shifts. A broadening top may indicate potential declines, while a broadening bottom can suggest an upcoming recovery. Understanding the implications of these price actions is crucial for achieving trading success. A case where novice traders misunderstood a broadening bottom, leading to an unnecessary loss, illustrates the significance of recognizing these patterns.

B. Key Terminology

- Price Action: The main movement of a security’s price over time, vital for spotting trading opportunities.

- Support and Resistance Levels: Psychological barriers that identify significant points where price trends might reverse, with resistance relating to upper trend lines and support corresponding to lower lines. To enhance understanding, the article Support and Resistance Levels: Key Concepts Explained elaborates on these crucial concepts.

- Volatility Measures: As broadening patterns take shape, recognizing the need for metrics that capture price fluctuations becomes critical—this is where analytical skills are vital.

IV. Identification Techniques for Broadening Patterns

A. Technical Indicators

- Trend Lines: Connecting peaks and troughs with trend lines helps reveal pattern structures and possible breakout zones—areas to watch closely for trading opportunities.

- Volume Analysis: A rise in trading volume during broadening patterns can signal trader confidence, supporting anticipated market movements. Refer to a case where traders applied volume analysis but didn’t act on a major price breakout, serving as a cautionary example.

B. Timeframe Considerations

- Patterns may appear differently across various timeframes. Daily and weekly charts typically present clearer formations, while intraday charts may generate excessive noise.

- By placing patterns within the wider market context, strategies can be refined, maximizing returns while reducing risk.

V. Trading Strategies

A. Entry and Exit Points

- Confirmed breakouts above resistance for broadening tops or below support for bottoms outline significant trading opportunities.

- Research by Firdous and Tiwari (2019) emphasizes that studies show trades based on broadening patterns can achieve success rates over 60%, highlighting the need for a thorough understanding of these signals for positive trading results.

B. Risk Management Techniques

- Setting stop-loss orders is essential for safeguarding capital against unexpected price changes—akin to an umbrella protecting against unpredictable market rain.

C. Psychological Considerations

Combining analytical strategies with emotional discipline is vital. Adopting a systematic approach empowers traders to counteract rash choices during the inevitable highs and lows of trading. For deeper insights, consider reading Understanding Trading Psychology: A Beginner’s Guide which offers valuable strategies for maintaining emotional control in trading.

VI. Critical Analysis of Broadening Patterns

A. Evaluating Effectiveness and Reliability

While broadening patterns present a promising approach, it is important to stay alert to interpretive biases; even the most experienced traders can misread signals. A situation where multiple traders misjudged a broadening pattern, leading to collective mistakes, underscores the need for accuracy in interpretation. Additionally, ongoing research into their effectiveness is crucial for success as a trader.

B. Alternative Patterns and Comparative Analysis

Understanding broadening patterns in relation to other formations—like head and shoulders or triangles—can significantly enhance overall trading strategy. Understanding Candlestick Patterns: A Comprehensive Guide complements this analysis by introducing key techniques of technical analysis relevant to strategies.

VII. Practical Applications

A. Real-Life Trading Scenarios

By examining specific case studies, one can discover successful trades utilizing broadening patterns and examples that did not succeed. The trading journey can be compared to finding one's way through a maze, where understanding broadening patterns lights the way to success. These real-world cases will enhance practical understanding while revealing common mistakes. Furthermore, strategies for managing stock market volatility can be found in How to Handle Stock Market Volatility: Tips for New Investors.

B. Personalized Trading Plans

Creating responsible strategies tailored to risk tolerance and financial goals is vital. Engaging with educational materials, joining trading forums where experienced traders share successful strategies using broadening patterns, and attending webinars can broaden knowledge and sharpen adaptability in the trading arena.

VIII. Areas for Future Research

A. Exploration Across Asset Classes

Examining broadening patterns across different asset classes—stocks, commodities, and cryptocurrencies—will provide essential insights into their effectiveness across various market environments.

B. Influence of External Factors

Economic events and macroeconomic indicators have major effects on market sentiment. Further research could clarify how these external factors influence the development of broadening patterns, thereby improving overall trading strategies.

IX. Conclusion

A. Summary of Key Findings

Broadening patterns act as essential tools for assessing market trends and understanding trader sentiment. These formations offer valuable insights into potential reversals, especially under the volatile conditions typical of trading environments.

B. Final Thoughts on Trading Broadening Patterns

By committing to ongoing learning, refining strategies, and using advanced market analysis tools, traders can enhance their approach to trading broadening patterns. Mastering broadening patterns equips traders with the skills needed to manage market volatility. Preparing to react quickly to the shifting landscape of financial markets will not only improve decision-making abilities but also strengthen independent trading skills.

X. References

Elder, A. (1993). Trading for a Living: Psychology, Trading Tactics, Money Management. New York: Wiley.

Fischer, D. (2011). Market Psychology: Factor Analysis and its uses in Technical Trading. Journal of Behavioral Finance, 12(3), 145-156.

Firdous, D., & Tiwari, A. (2019). Empirical Analysis of Pattern Trading Strategies. Journal of Financial Markets, 27, 15-30.

Neill, J. (2016). The Art of Trading: A Complete Guide to Trading Technical Analysis. London: Harriman House.

Pring, M. J. (2002). Technical Analysis Explained: The Successful Investor's Guide to Spotting Investment Trends and Turning Points. New York: McGraw-Hill.