I. Introduction

A. Background and Significance

Many investors recognize the potential hidden gems, such as small-cap growth stocks. If you’re thinking about adding these stocks to your investment portfolio, you’re joining those who appreciate the unique potential in this market segment. Small-cap stocks, typically defined as companies with market capitalizations ranging from $300 million to $2 billion, often represent extraordinary growth opportunities. These companies are usually in their early growth phases, allowing them to adjust quickly to new market trends and innovations. This ability to adapt can lead to impressive returns, especially when the economy is doing well. Historical analyses have shown that during times of economic recovery, small-cap stocks tend to perform better than large stocks. This emphasizes the considerable advantages of investing in this area during favorable economic times. For beginners in investing, grasping the market is essential; you might find the article on Understanding the Stock Market: A Beginner’s Guide useful for building a strong foundation.

In the current fast-paced financial world, shaped by rapid technological advancements and changing consumer preferences, investing in small-cap growth stocks can be a rewarding venture. However, it’s crucial to approach the inherent risks with care and understanding.

B. Purpose of the Paper

This essay aims to shed light on the complexities surrounding small-cap growth stocks by exploring both their opportunities and risks. By examining historical performance, current market conditions, and key economic factors, we aim to give you—whether you're an investment advisor, finance professional, or an individual investor—essential insights to succeed in this dynamic yet sometimes volatile segment.

II. Understanding Small-Cap Growth Stocks

A. Definition and Characteristics

Small-cap growth stocks are the seedlings of the market, nurtured in the rich soil of innovation and potential, ready to grow into strong businesses. These shares represent companies that are set for rapid expansion but have not yet reached mid- or large-cap status. Unlike larger corporations that may pay dividends to attract investors, these firms often reinvest earnings to drive growth. For instance, small firms typically focus on reinvesting their earnings to encourage further growth, unlike the frequent dividend payouts seen in bigger firms. This distinct strategy fits the growth-oriented mindset that characterizes many small-cap stocks. Understanding these unique traits helps you evaluate their dynamics and find their potential roles in your diversified portfolio. Investors often discover that monitoring these emerging firms resembles a strategic game of chess—where planning and foresight are crucial.

B. Market Behavior

Investing in small-cap stocks involves specific challenges, especially regarding volatility. These stocks usually experience greater price fluctuations than their larger counterparts, which is due to their increased sensitivity to economic changes and lower trading volumes. Research shows that small-cap stocks tend to be more volatile compared to large-cap stocks, leading to more significant price variations. This inherent volatility requires solid investment strategies and a firm grasp of market behavior. Notable sectors where you can discover exciting small-cap growth opportunities include technology, healthcare, and renewable energy—each thriving on changing consumer demands and ongoing technological advancements. To learn more about how growth stocks function and how to invest in them effectively, you may want to check out What Are Growth Stocks and How to Invest in Them?.

III. Opportunities in Small-Cap Growth Stocks

A. Growth Potential

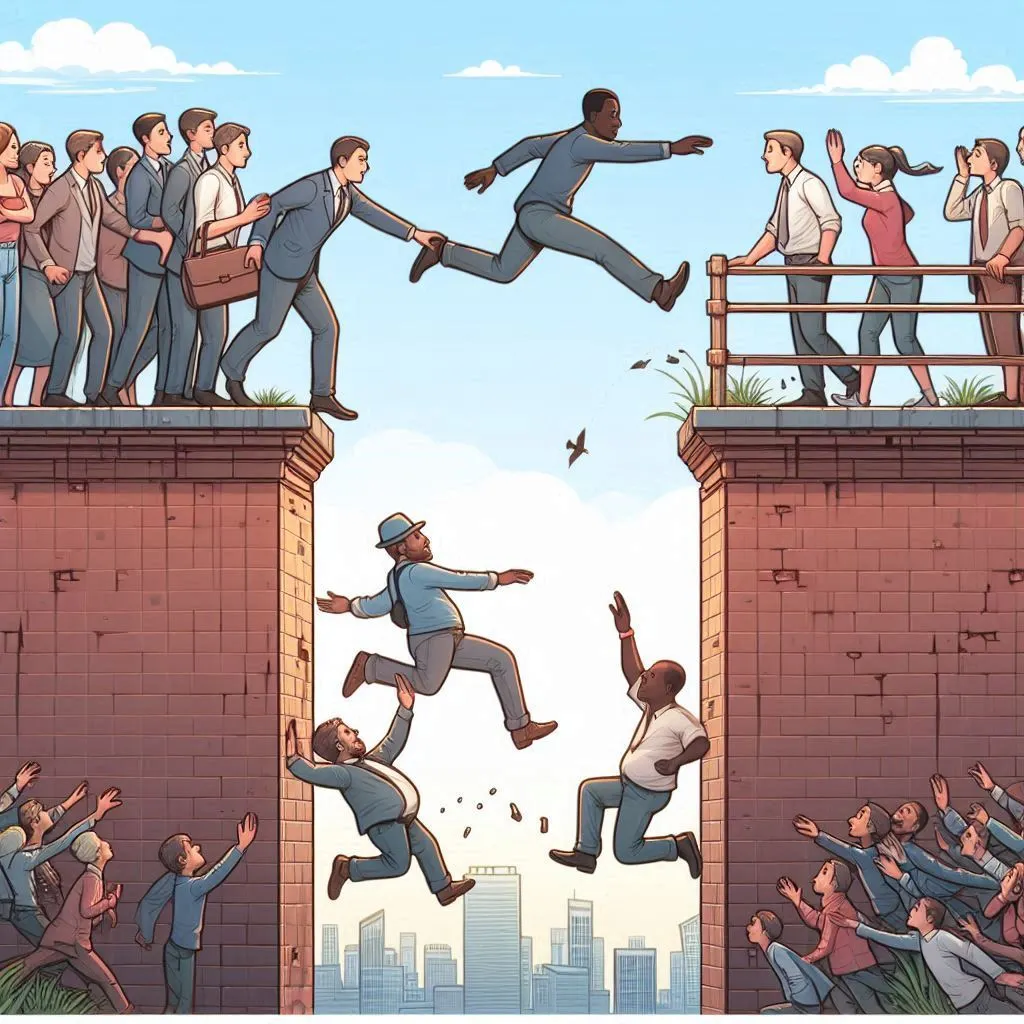

The most appealing aspect of small-cap stocks is their significant growth potential. In many cases, the careful investor takes on the role of a treasure hunter, searching through the market to find undervalued stocks. Many of these companies embody neglected opportunities filled with untapped potential. Research has indicated that over the long term, small-cap stocks have outperformed large-cap stocks, providing investors with greater growth opportunities. This historical pattern highlights the substantial advantages of directing resources toward these promising stocks. For example, Zoom Video Communications—before its rapid rise—was just another small-cap stock. This illustrates the rewards linked to early investment awareness. By diligently identifying similar opportunities in the current market, you can achieve remarkable returns. To help you find high-growth companies, consider the strategies outlined in How to Identify High-Growth Companies for Your Portfolio.

B. Market Inefficiencies

Often overlooked by institutional investors, small-cap stocks offer unique chances for individual investors willing to invest time in thorough research. By identifying and taking advantage of market inefficiencies, you can position yourself for significant growth, as long as you’re ready to conduct in-depth research. Recognizing the importance of diversification can significantly lower risks—insights that are discussed in the article The Importance of Diversification in Stock Investing.

IV. Risks Associated with Small-Cap Growth Stocks

A. Volatility and Market Sensitivity

Investing in small-cap stocks is like going on a thrilling roller-coaster ride—where sharp climbs can quickly lead to steep drops, requiring resilience and preparation from investors. Price changes can be significant—especially during economic declines—when shifts in investor sentiment can strongly influence smaller firms. Understanding this volatility is crucial for making informed investment decisions. The need for a careful approach highlights that investors should conduct thorough research and understand economic factors to succeed with small-cap stocks. To help manage this volatility, I recommend reading How to Handle Stock Market Volatility: Tips for New Investors.

B. Liquidity Concerns

Liquidity is another important factor. As small-cap stocks usually have lower trading volumes, buying or selling shares can greatly affect their market prices. It has been noted that the lower trading volumes of small-cap stocks can result in liquidity issues, which directly influence their prices. Understanding these liquidity challenges allows investors to refine their investment strategies more effectively and contribute to a more stable portfolio.

C. Company-Specific Risks

In addition to general market risks, each small-cap company may face unique challenges, such as management problems or financial instability. Historical examples often illustrate cautionary tales, underscoring the need for thorough analysis and careful investment practices. Investors must weigh potential rewards against inherent risks when considering small-cap growth stocks, as the possible high returns of these stocks come with significant risks that require careful consideration.

V. Investment Strategies for Small-Cap Growth Stocks

A. Active vs. Passive Strategies

As you explore the landscape of small-cap investing, making a choice between active management strategies and passive approaches is vital. Assessing the pros and cons of each method will help you determine a strategy that aligns with your goals and risk tolerance. For a deeper understanding of different investment styles, including the benefits of active versus passive strategies, look into The Differences Between Active and Passive Investing.

B. Evaluation Metrics

To identify promising small-cap stocks, it’s essential to master key performance indicators. Important metrics to examine include revenue growth rates and earnings per share, which are crucial for evaluating the potential of small-cap investments. As discussed, revenue growth and earnings per share are key indicators in assessing small-cap investment potential. This analytical approach equips investors to make strategic choices aligned with long-term growth goals.

C. Diversification Approaches

Integrating small-cap stocks into a diversified portfolio acts as a protective measure, softening the effects of volatility across different sectors. Utilizing sector diversification allows you to spread investments across various industries, thereby minimizing the risks of downturns in specific sectors. As noted, spreading investments across different asset classes, including small-cap stocks, can reduce overall portfolio risk linked to market fluctuations. To build a more diversified growth stock portfolio, check out How to Build a Diversified Growth Stock Portfolio.

VI. Areas for Further Research

A. Economic Factors

Exploring how macroeconomic indicators, like inflation, interest rates, and GDP growth, influence small-cap stock performance opens up important avenues for further study. Investors often gain insights similar to detectives piecing together how broader economic trends affect specific stock performances. Keeping aware of these dynamics boosts your ability to spot potential investment opportunities.

B. Technological Advances

Understanding how groundbreaking technological innovations shape the growth paths of small-cap companies is essential. New technologies can reshape business models, helping these firms capture significant market share and enhance their values.

C. Behavioral Finance Elements

Finally, researching the behavioral aspects related to small-cap investing can provide valuable insights. Being aware of psychological biases improves your ability to make disciplined decisions in this complex environment.

VII. Conclusion

A. Summary of Key Findings

Investing in small-cap growth stocks is like walking a tightrope, where keeping your balance between thrilling highs and risky lows requires keen awareness. This presents a two-sided issue—offering attractive opportunities while also bringing challenges such as volatility and market risks. The insights shared highlight the importance of a balanced viewpoint that considers potential rewards alongside associated risks.

B. Recommendations for Investors

For those ready to start on this investment journey, engaging in thorough research paired with customized risk management strategies is essential. Balancing quantitative analyses with qualitative insights prepares you to approach this complex field with greater confidence. Enhancing this strategy with well-defined financial goals can further strengthen your approach.

C. Final Thoughts

While the world of small-cap investing is full of potential, it requires careful attention and insight. By focusing on thorough research and developing a detailed understanding of the market dynamics at work, you’ll be better prepared to traverse the complex terrain of small-cap stocks—ultimately paving the way for rewarding long-term growth.

VIII. References

Amihud, Y. (2002). Illiquidity and Stock Returns: Cross-Section and Time-Series Effects. Journal of Financial Markets, 5(1), 31-56.

Barber, B. M., & Odean, T. (2000). The Courage of Misguided Convictions: The Trading Behavior of Individual Investors. Financial Analysts Journal, 56(6), 41-55.

Black, F., & Scholes, M. (1973). The Pricing of Options and Corporate Liabilities. The Journal of Political Economy, 81(3), 637-654.

Dimson, E., Marsh, P., & Staunton, M. (2013). Credit Suisse Global Investment Returns Yearbook 2013.

Fama, E. F., & French, K. R. (1992). The Cross-Section of Expected Stock Returns. The Journal of Finance, 47(2), 427-465.

Hwang, N., & Satchell, S. (2005). The Dividend Policy of Small Firms. Journal of Small Business Management, 43(3), 307-324.

Ibbotson, R. G., & Chen, P. (2003). The Value Premium and the Equity Risk Premium. Financial Analysts Journal, 59(5), 22-29.

Markowitz, H. M. (1952). Portfolio Selection. The Journal of Finance, 7(1), 77-91.

Penman, S. H. (2001). Financial Statements Analysis and Security Valuation. McGraw-Hill/Irwin.