I. Introduction

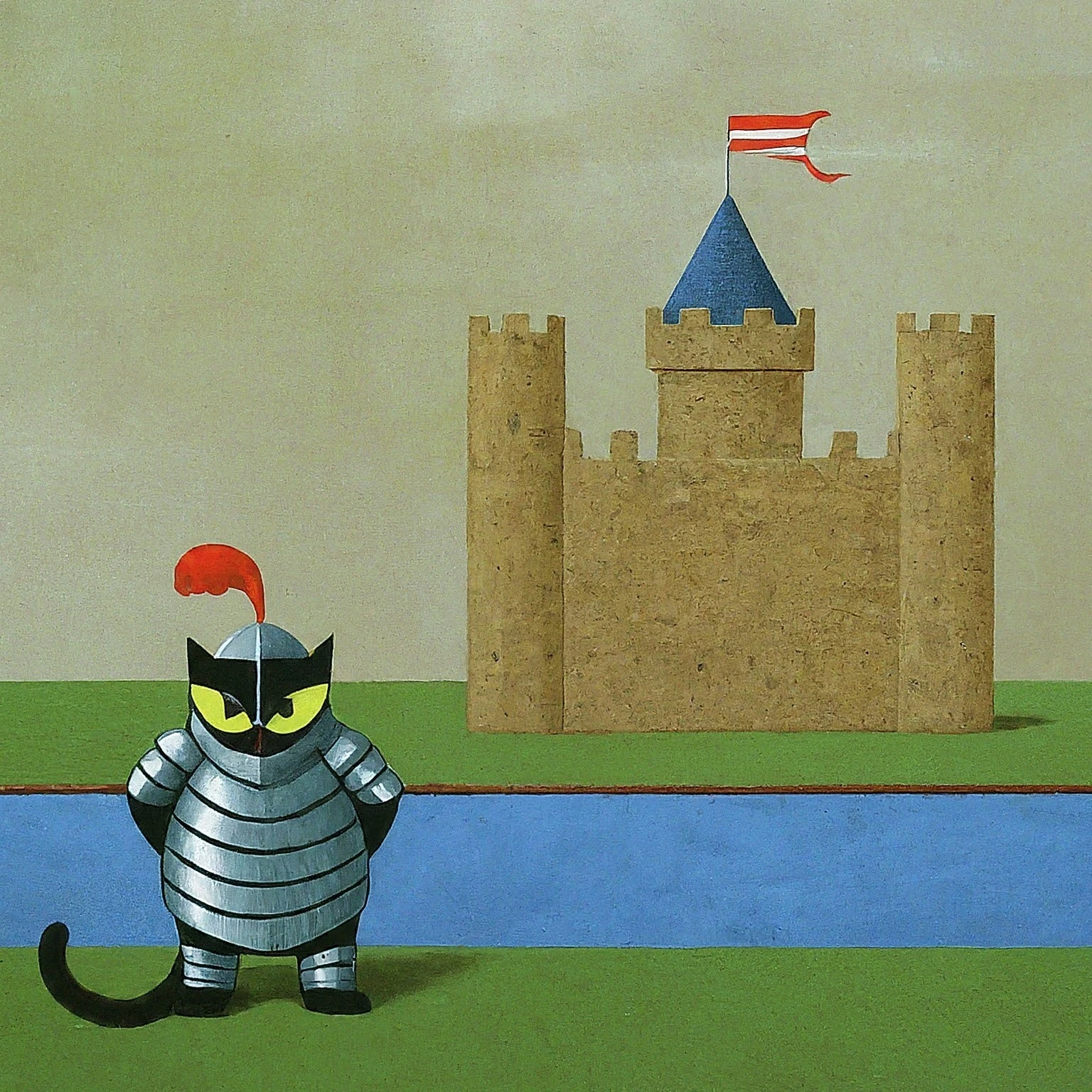

Imagine a lively market square, where vendors vie for customers' attention with colorful signs and clever slogans, but only a few stand out with truly distinct competitive asymmetries. If you've ever dabbled in the investment world—especially with insights inspired by Warren Buffett—you’ve encountered the term competitive moat. Picture a medieval fortress surrounded by a deep, water-filled ditch: this moat protects it from invading competitors. In the business realm, a competitive moat represents the distinctive competitive asymmetries that empower a company to safeguard its market position and sustain profit margins over time. Competitive moats are crucial for safeguarding a company's market position and sustaining profit margins over time. According to Porter (1985), "A company's ability to sustain a competitive advantage depends on the strategies it pursues to protect its market position and profits against competitors" (p. 3). For savvy investors, grasping these nuances is not just beneficial; it is crucial for comprehending how these protective barriers can reveal a company’s resilience during market fluctuations. This understanding significantly enhances long-term profitability. For more fundamental knowledge, consider reading Understanding the Stock Market: A Beginner’s Guide.

In this essay, we will explore various forms of competitive moats and their vital role in fundamental analysis. By categorizing these moats, providing historical examples, and examining their significance in investment strategies, we aim to enrich your understanding and elevate your decision-making processes within the stock market. In the current fast-paced market, a thorough grasp of competitive moats is essential for developing effective investment strategies and evaluating a company's long-term viability. This paper illustrates how identifying distinct types of moats and analyzing their impacts on financial performance can profoundly enhance your investment results.

II. Literature Review

A. Historical Background of Competitive Moats

The concept of competitive moats has gained attention through Warren Buffett’s investment philosophy, which underscores the importance of sustained competitive advantages for long-term success. Buffett points out that a strong competitive advantage enables a company to keep its pricing power, thus earning better returns over time (Buffett, 1996). This assertion emphasizes the core role that competitive advantages play in safeguarding a company's profits and market share. As businesses evolve like chameleons adapting to their environments, understanding the developing shapes of competitive moats is essential for investors who wish to stay ahead. This evolution urges investors to adjust their analyses accordingly.

B. Current Trends in Competitive Moats

The business landscape is constantly evolving, leading to the emergence of new forms of competitive moats at an unprecedented pace. Companies within technology and e-commerce sectors, for instance, leverage data analytics and expansive customer networks, solidifying their market positions. McKinsey & Company (2016) notes that firms using big data analytics not only improve their decision-making but also create competitive moats by providing value in ways that traditional businesses cannot. This highlights the transformative potential of data in establishing competitive barriers in a rapidly changing market. Consider how traditional bookstores transitioned to online platforms; firms that adapted quickly reaped the benefits of competitive moats, illustrating the vital nature of agility in business. If you're looking to acquire insights into the mechanics of stock markets, look into How Does the Stock Market Work? Simplified Concepts for Beginners. To thrive in this interconnected economy, businesses must continually refine their strategies, adjusting to changes rather than relying solely on established advantages.

C. Key Contributors to the Field

Prominent figures, such as Warren Buffett and Pat Dorsey from Morningstar, have shaped discussions on competitive moats. Foundational texts, like Michael Porter’s "Competitive Advantage," equip investors with invaluable insights into market dynamics and strategic positioning. Johnson and Scholes (2002) state that blending qualitative insights with quantitative analysis results in a more thorough evaluation of competitive moats and their effects on business strategies. Their work highlights the necessity of a multi-dimensional approach to fully grasp competitive advantages, which is essential for gaining an edge in the ever-competitive financial landscape.

III. Methodology

A. Research Design

This research employs a hybrid approach, intertwining qualitative and quantitative methodologies. It includes case studies of well-regarded companies that successfully maintain competitive moats, alongside empirical analyses that assess these advantages through relevant metrics.

B. Data Sources

Data for this research is gathered from a variety of sources, including academic journals, market reports, financial statements, and interviews with financial professionals. This comprehensive approach encourages a nuanced perspective, accurately reflecting the complexities surrounding competitive moats.

C. Criteria for Evaluating Competitive Moats

Our evaluation focuses on identifying the different types of moats, using analytical tools such as SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) and relevant financial ratios to provide deeper insights into a company’s economic position. Such detailed analysis allows investors to form a clear picture of a company's competitive standing against its peers.

IV. Definition and Types of Competitive Moats

A. Economic Moats

Economic moats appear in several distinct forms:

- Brand Loyalty: Companies like Coca-Cola show how strong customer loyalty helps them keep market dominance, even when facing stiff competition. In the saturated soft drink market, the lasting competition between Coca-Cola and Pepsi illustrates how brand loyalty serves as a moat protecting market share.

- Cost Advantages: Corporations like Walmart benefit from economies of scale, enabling them to provide lower prices than their competitors effectively.

- Network Effects: Platforms like Facebook increase in value as their user bases grow, creating a self-reinforcing competitive advantage. To understand the increasing importance of such networks, see What Are ETFs and Should You Invest in Them?.

- Regulatory Barriers: The pharmaceutical sector enjoys patents that prevent new competitors from entering the market, safeguarding their market share.

- Intellectual Property: Unique technologies or patented products offer important advantages over potential imitators.

B. Comparison Across Industries

The traits of these moats can differ significantly among various sectors. For instance, technology firms often prioritize innovation and brand strength, while traditional consumer goods companies may focus on cost leadership and brand loyalty.

V. Role of Competitive Moats in Fundamental Analysis

A. Relevance to Investment Strategies

Identifying competitive moats is critical for creating sustainable investment plans. These moats signify a company's ability to generate lasting profits. Competitive moats guide investors through turbulent times, illuminating the path to sustainable profits. Savvy investors actively seek firms that display clear competitive moats, recognizing that such companies reflect resilience during economic downturns while sustaining growth. For insights into diversification strategies that complement this understanding, check The Importance of Diversification in Stock Investing.

B. Quantitative and Qualitative Measurements

Evaluating competitive moats requires the use of both quantitative metrics—like return on equity—and qualitative evaluations that include factors such as management quality, brand reputation, and customer loyalty. The interaction between these elements highlights the necessity of a nuanced analytical framework that captures the intricacies of competitive dynamics.

C. Challenges in Evaluating Moats

Analysts may face potential biases in their assessments, particularly the tendency to place too much value on historical data. Accurately evaluating competitive moats requires awareness of the changing nature of markets and shifts in consumer behavior. It's essential to recognize that no single strategy fits all; each evaluation calls for a context-driven approach that acknowledges these complexities.

VI. Case Studies

A. Successful Companies with Strong Competitive Moats

- Coca-Cola: Coca-Cola showcases the importance of brand loyalty, granting substantial pricing power and market influence.

- Apple: Apple's cohesive ecosystem and strong brand identity foster lasting competitive advantages surrounding its products.

- Amazon: Amazon’s logistical ability combined with established network effects demonstrates a self-reinforcing business model that strengthens its competitive position.

B. Companies that Lost Their Moats

- Blockbuster: The story of Blockbuster illustrates the risks of neglecting market shifts, like a ship that fails to change course during an approaching storm. Blockbuster's decline serves as a warning, highlighting the dangers of not adapting to technological changes and evolving consumer preferences.

- Motorola: Once a market leader, Motorola’s failure to innovate in a timely manner allowed competitors to capture significant market share, leading to its decline.

VII. Critical Analysis

A. Current Debates

Recent discussions often focus on the durability of competitive moats. The ever-changing landscape of competitive moats resembles a dance of adaptation, as companies shift seamlessly to stay relevant. Some experts contend that these advantages may become more temporary due to rapid technological progress, challenging traditional categories of moats. Consequently, companies must also incorporate Environmental, Social, and Governance (ESG) factors into their strategies to foster new competitive advantages that resonate with consumers in a progressively socially aware market.

B. The Role of ESG Factors in Moat Analysis

As consumer behavior evolves, companies neglecting ESG factors often find themselves at a disadvantage, akin to boats stranded on dry land. With the rise of ethical investments, companies demonstrating strong ESG practices may cultivate competitive advantages that positively affect their market position.

VIII. Recommendations

A. For Investors

For investors, developing methods to identify and make the most of competitive moats is crucial. Utilizing analytical tools like SWOT analysis alongside relevant financial metrics can greatly improve due diligence efforts, equipping you to make well-informed investment choices. However, it’s important to remember that no method ensures success; adaptability remains essential. If you're new to assessing companies, you might find it useful to explore How to Use Fundamental Analysis to Pick Stocks.

B. For Businesses

Picture a flourishing garden; it demands constant care. For businesses, maintaining a competitive moat requires ongoing innovation and strategic flexibility, consistently pursuing actions to strengthen their advantages in an ever-changing market.

IX. Conclusion

A. Summary of Key Findings

This exploration underscores that competitive moats are essential for assessing a company’s long-term viability. Strong moats align closely with stability and sustained growth, reaffirming their importance as integral to investment strategies. In the investment arena, competitive moats act as the foundation, supporting sustainable investment plans amid the shifting sands of market fluctuations.

B. Future Implications

Future research should delve into how market changes can affect the sustainability of competitive moats—especially regarding rapid technological developments and evolving consumer preferences. History shows us that those who grasp competitive moats often reap the rewards of their efforts, similar to skilled farmers harvesting from well-tended fields. Insights from such research will be essential for fostering business sustainability in a dynamic market. For a broader view of market trends, consider reading The Future of Growth Investing: Trends to Watch.

X. References

Buffett, W. E. (1996). The Superinvestors of Graham-and-Doddsville. Columbia Business School.

Johnson, G., & Scholes, K. (2002). Exploring Corporate Strategy: Text and Cases. Prentice Hall.

McKinsey & Company. (2016). The Age of Analytics: Competing in a Data-Driven World.

Porter, M. E. (1985). Competitive Advantage: Creating and Sustaining Superior Performance. Free Press.